J.B. Hunt's Equipment Dilemma: Pandemic Expansion Meets Post-Boom Reality

Look at what $JBHT management said during the last conference call: “…we still have really significant capacity that’s underutilized. And the cost to store that equipment is a significant headwind for us. And so as we continue to scale and grow our volumes, while also improving pricing, that’s going to be our focus and our effort. The Walmart equipment, we reported – I think we reported just over 122,000 containers at the end of 4Q. When we onboarded the Walmart equipment, all of that equipment requires a modification and we haven’t completed that work. Clearly, we just did the acquisition in, I think, the second quarter of – or end of first quarter, second quarter last year. And that equipment is tucked away in storage right now because frankly, we’re still trying to grow into the 122,000 containers that you can see we own today.”

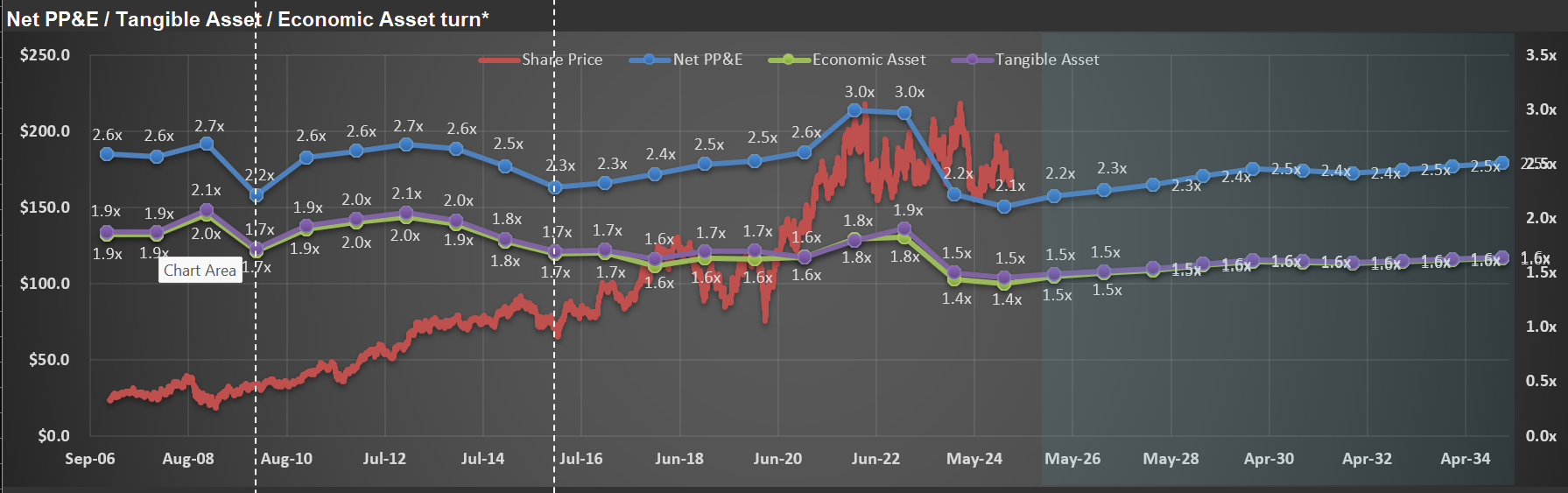

This was a classic over-investment situation, given the strong cycle for trucking companies during the pandemic (mostly on pricing, as companies were willing to pay anything to secure transportation capacity). The result: a very low “Net PP&E turnover”—see the blue line on the chart. It is as low as in the deep recession years of 2009.