Carter's 2025 Forecast vs. Reality: A Humbling Lesson in Long-Term Guidance

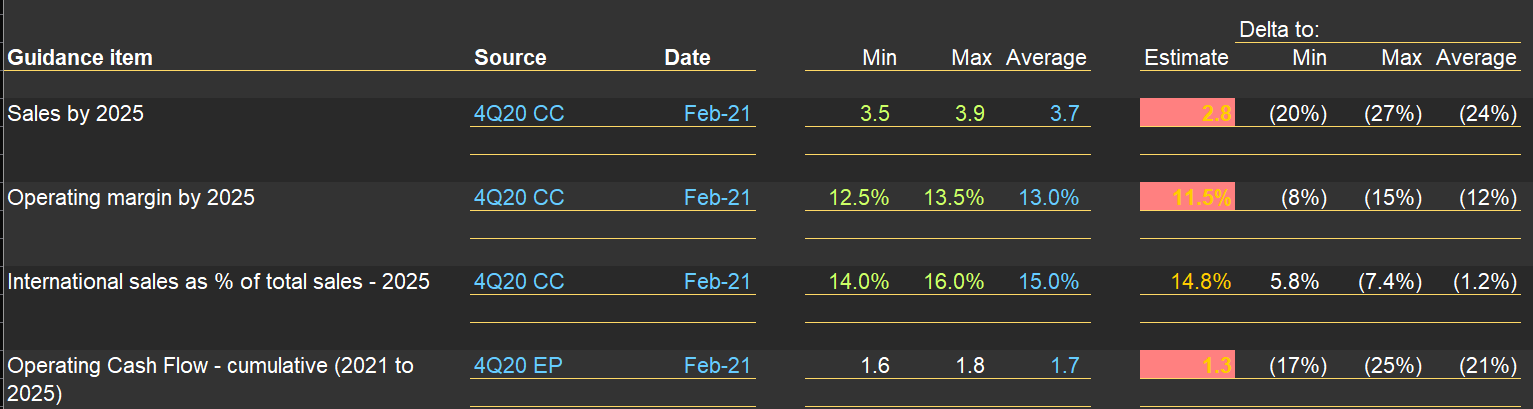

Companies usually provide “guidance” for short term expectations. It helps when there are more complex changes in the P&L (for instance, after an acquisition and/or disposal). But sometimes, they provide longer-term guidance, as did $CRI (Carter’s) management in early 2021. The picture below shows their guidance for 2025 (on the left). On the right, what might happen (as we are now entering the “target year”). The delta between expectations vs. reality is significant (and I’m using a “normalized margin” for 2025 - the actual is expected to be closer to 7%). This example underscores how difficult it is to make forecasts. If it is that hard for a company’s management team that sells baby clothes, founded 160 years ago, can you imagine your chances to forecast sales and profitability in the technology field correctly? If you want to invest (instead of speculate), focus on mundane businesses. And even so you will be humbled by your mistakes!