Is CSX's Growth Engine Losing Steam?

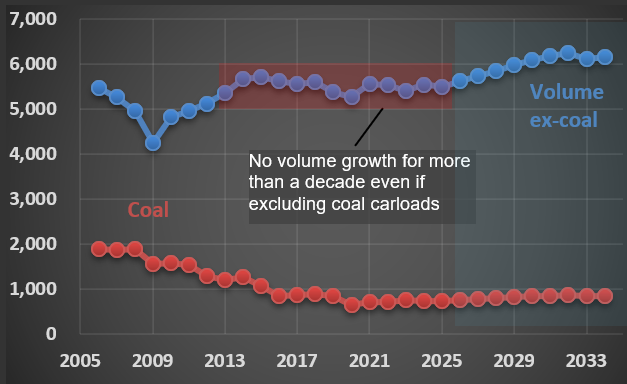

I’m currently analyzing $CSX (CSX Corporation), one of the leading railroad operators in the US. Look at the chart below: the red line represents coal carloads, which have significantly declined over the past two decades as the country transitions away from coal as an energy source.

The blue line shows carloads for all other industries CSX serves—think chemicals, materials, minerals, forest products, automotive (from parts to finished vehicles), and intermodal containers (those versatile boxes that seamlessly move between trucks, trains, and ships). Interestingly, volumes for these categories have remained relatively flat over the last 13 years.

Yet, despite stagnant volumes, CSX’s earnings per share—and consequently its share price—have risen considerably during this period. This growth has primarily been driven by aggressive cost-cutting measures and consistent price increases, enabled by the duopoly structure common among railroads. However, recent slow declines in margins could suggest that this favorable dynamic is beginning to shift.