Is Sleep Number ($SNBR) Feeling the Weight of Consumer Recession?

When analyzing a company, understanding the industry it operates in is essential. Today, I’m focusing on $SNBR (Sleep Number Corporation), a company whose valuation history over the past 20 years has been remarkably volatile. This volatility stems from the cyclical nature of the mattress manufacturing and retailing industry, compounded by decisions made by two consecutive CEOs to leverage the company ahead of major industry downturns.

While the leverage applied in both cases wasn’t excessive, Sleep Number operates with a naturally leveraged business model due to its reliance on rented stores, which adds fixed costs to its P&L. During the Great Financial Crisis (GFC), the company nearly collapsed despite carrying only a modest debt load (but eventually managing to pay down all its debt). Fast forward to recent years: the outgoing CEO—who earned nearly $80 million during her tenure—chose to leverage the company again by authorizing $1.6 billion in share buybacks. The result? Sleep Number now faces significant financial strain with $550 million in debt.

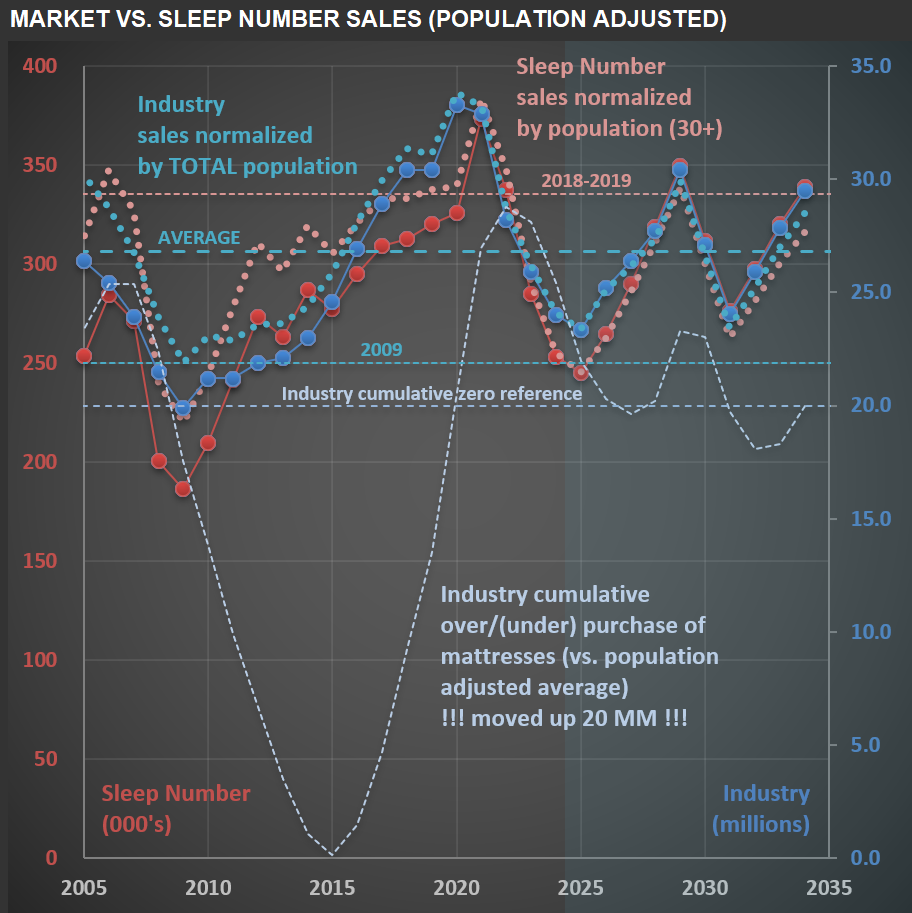

The chart below provides a visual overview of Sleep Number’s sales (in red) over the past 20 years and projects a base-case scenario for future sales. It also compares these figures to unit sales for the entire mattress industry (in blue). Unsurprisingly, the two are closely correlated—any shifts impacting the broader industry inevitably affect Sleep Number. The dotted light-blue/red lines adjust these figures for population dynamics. For the overall mattress industry, I use the total population. However, for Sleep Number, I focus on individuals aged 30+ years who are more likely to purchase their premium mattresses.

Several reference lines on the chart offer additional context. One highlights industry sales levels during 2009, which we’re approaching but haven’t quite reached yet. If mattress unit sales decline by another million in 2025, per capita mattress sales will align with GFC levels—a concerning benchmark. Another line (light blue) illustrates cumulative under- or over-purchasing trends within the industry. Even if recent declines reflect a correction from prior excesses, seeing per capita sales nearing 2009 levels is striking. This aligns with broader indications that American consumers are facing recessionary pressures—a topic I’ve explored in previous posts.