Tracking $EXPD Through the Global Tariff Storm

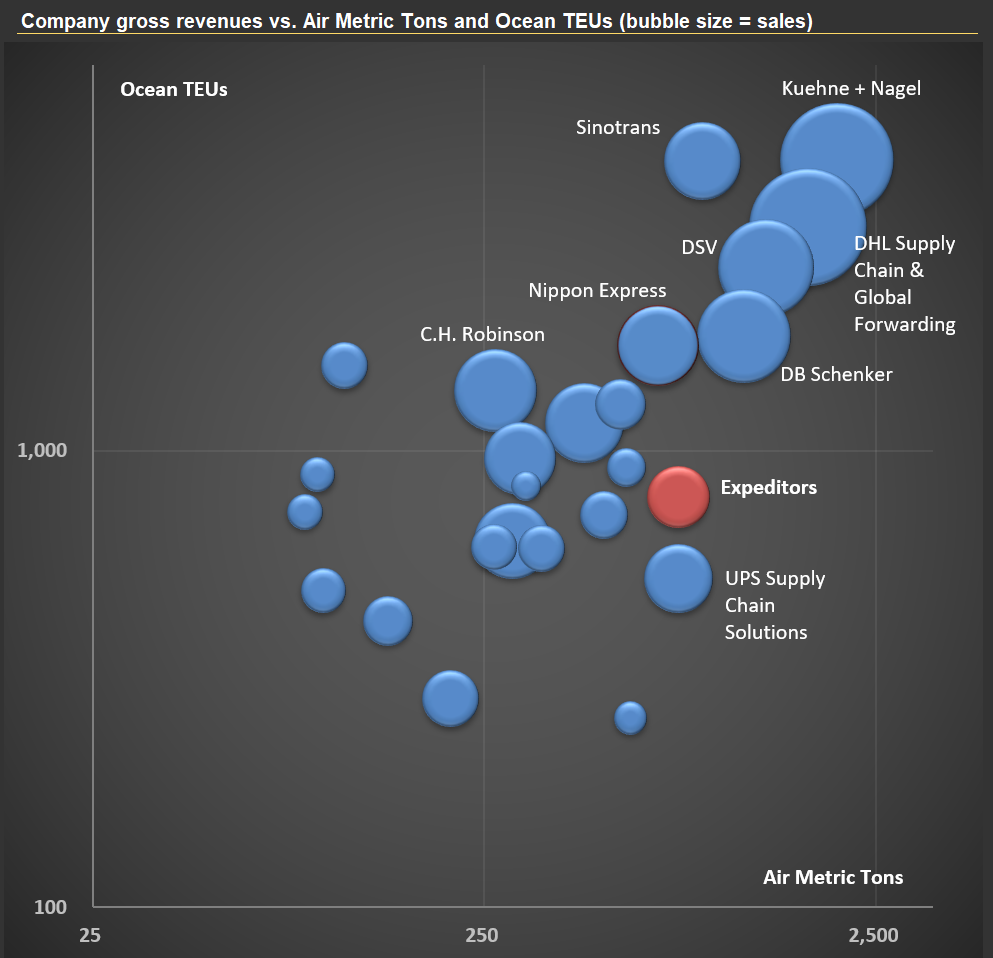

I’m working on Expeditors International of Washington, Inc. ($EXPD) today. $EXPD is a Fortune 500, non-asset-based logistics company providing highly customized global supply chain solutions—including air and ocean freight forwarding, customs brokerage, warehousing, and distribution—through a network of more than 340 offices in over 100 countries. The company employs around 18,000 people.

The “non-asset-based” model in logistics means that $EXPD does not own the trucks, ships, planes, or warehouses used to move and store goods. Instead, it acts as an intermediary, leveraging a broad network of third-party carriers and service partners to coordinate and manage logistics operations for clients. This approach offers flexibility and scalability, allowing $EXPD to tailor solutions, adapt quickly to changing demands, and often reduce costs by avoiding the burden of maintaining its own fleet or facilities. In the first picture below, you’ll see the top 25 players in the global logistics sector, with $EXPD highlighted in red.

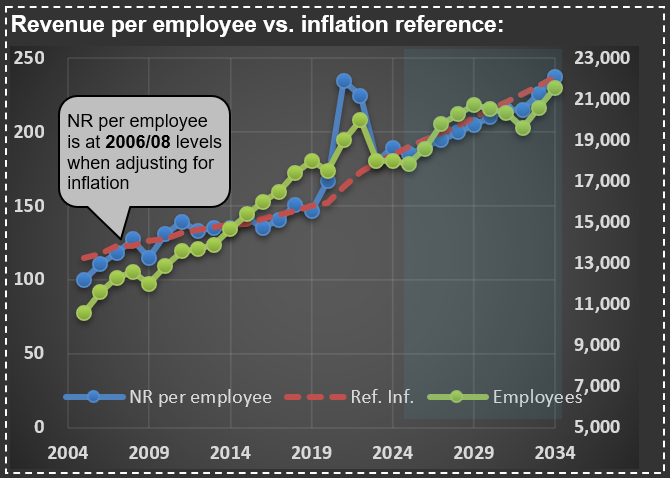

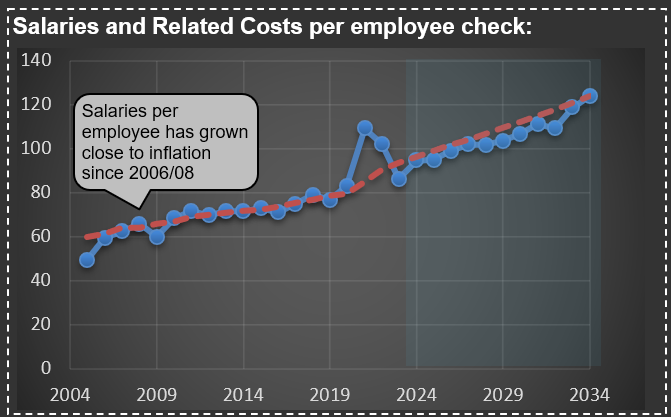

One aspect of $EXPD’s business that stands out—see the next two charts—is how little its “Net Revenue” (revenue excluding pass-through transportation costs) and employee compensation have changed in real terms over the past 20 years. Adjusted for inflation, both metrics are essentially at the same level as they were two decades ago. Intuitively, I would have expected costs per employee to decline, given the advances in computing power and process automation during this period.

The lesson: trust your intuition less, and make sure you have enough information to understand what’s actually driving a company’s revenue and costs. I’ll be watching $EXPD and its competitors closely—they’re at the center of the ongoing global tariff disputes, and their financials should eventually reflect the consequences of any shifts in the rules of the game