How Government Incentives Are Shaping $WM’s Capital Decisions

Today, I’m deep into my analysis of $WM (Waste Management). On any given day, the company’s teams collect waste and recyclables from 21 million homes and businesses, operate fleets along set routes, and move materials to processing or disposal facilities.

As I incorporate insights from the latest Investor Day, I’m reminded how influential—and sometimes questionable—regulations can be from an economic perspective. Back in 2016, nearly a decade ago, I added a note on the CapEx (capital expenditure) section of the WM’s model: “Since 2005, organic growth has been mostly negative—therefore, I will assume no Growth CapEx; this means that recent CapEx is an excellent estimate of necessary Maintenance CapEx.”

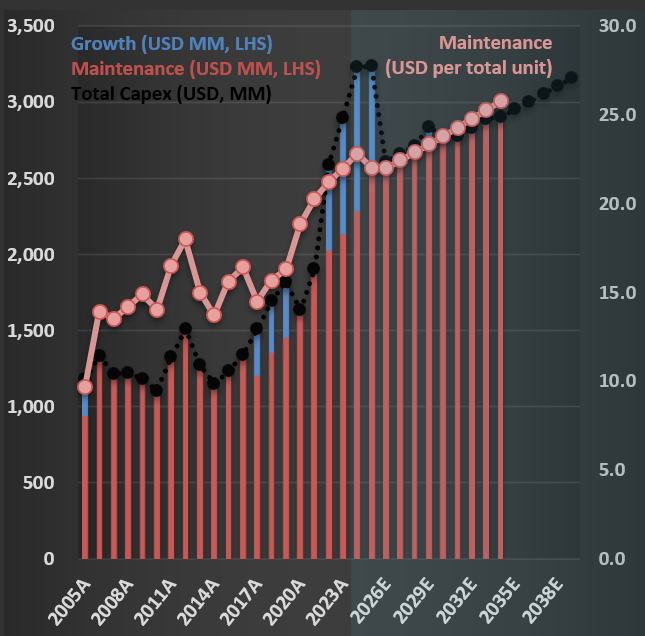

That forecast primarily held. For years, most of Waste Management’s CapEx focused on maintaining existing operations. If you look at the first chart below, you’ll see that CapEx was, until 2022, dominated by red (Maintenance CapEx), with only a modest amount in blue (Growth CapEx). But in 2022, there’s a clear uptick in growth investment. What changed?

The answer lies in the Inflation Reduction Act (IRA), which introduced a range of incentives for renewable energy. RNIs (Renewable Identification Numbers) and LCFS (Low Carbon Fuel Standard) credits now make producing RNG (Renewable Natural Gas) from landfills “economically” attractive.

Why the quotation marks around “economically”? If you dig into the actual costs of producing RNG from landfills, estimates range from $ 7.50 to $ 21.50 per MMBtu. For context, take a look at the second figure below, which shows the price of natural gas in the U.S. over the last 20 years. The green line marks the lowest cost to produce RNG—notice how it compares to market prices. In other words, without incentives, RNG production is not profitable.

The key risk for Waste Management is that if government incentives are withdrawn, these new assets could quickly become uneconomical, even if we treat the initial CapEx as a sunk cost. Time will tell whether this was a prudent long-term investment.