Consumer Weakness and Tariff Pressures: Inside $HELE’s Latest Results

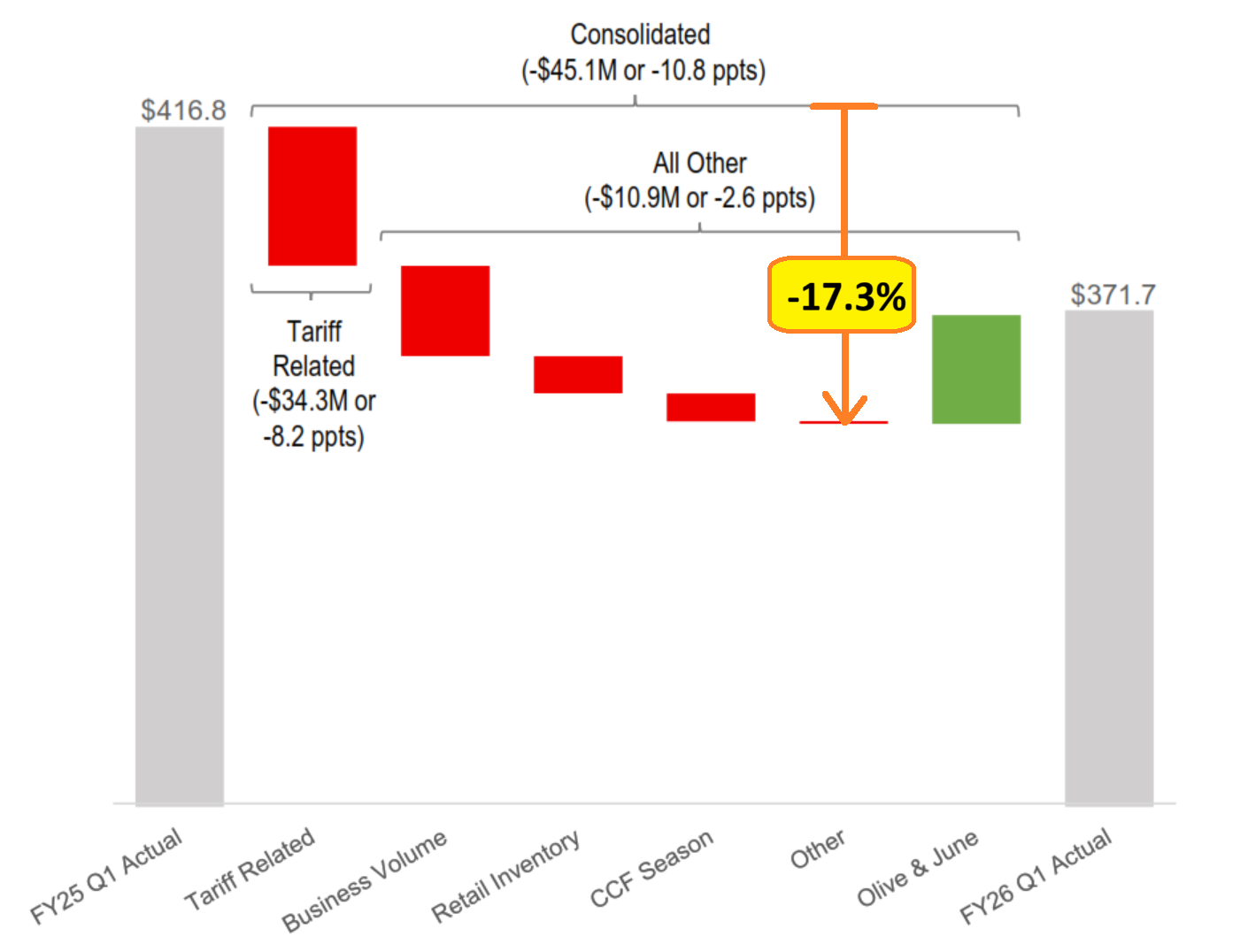

Yesterday brought the first quarterly earnings release from $HELE (Helen of Troy), and the impact of tariffs was unmistakable. The company reported its 1QFY26 results[*], and the numbers were sobering. Excluding the effect of its recent acquisition, sales declined 17.3% year-over-year (see picture below).

Helen of Troy markets a range of consumer goods through brands you likely recognize. In their Home & Outdoor segment, they own OXO, Osprey, and Hydro Flask. In Beauty & Wellness, they own or have the rights to brands such as Revlon, Honeywell, Vicks, Braun, Olive & June, and others. If you’re curious, you can browse their products here.

What stands out from the report is the company’s ability to pinpoint sales lost directly to tariffs. Some clients deliberately held off on orders, hoping to ride out the current tariff environment and replenish inventory later—ideally at a lower tariff rate, but without sacrificing sales in the meantime.

Not all of the sales decline could be tied to specific customer actions. The company also classified portions as “business volume” losses and “retail inventory” adjustments. Regardless of the breakdown, this marks the fourth consecutive year of declining sales at $HELE. The first two years could be chalked up to post-pandemic normalization. Still, the last two years reinforce a trend I’ve highlighted here before: American consumers are simply not consuming at pre-pandemic levels.

Even if, over time, imported products are replaced by domestic alternatives, the initial effect is predictably negative. For $HELE, it’s highly unlikely their contract manufacturers will relocate production to the US—labor costs are simply too high for US-based factories to compete with Asian manufacturers, even if tariffs reach triple digits.

It remains to be seen how the shifting US tariff landscape will ultimately shape the broader economy.

[*] Their fiscal quarters end in February, May, August, and November.