The Manufacturing Construction Surge: Signal or Noise for $FAST?

As I work on my analysis of $FAST (Fastenal)—a major industrial and construction supply distributor specializing in fasteners and related maintenance, repair, and operations (MRO) products—I’ve decided to update my analysis tracking construction spending in the USA. After all, the more activity there is in this sector, the more demand Fastenal might see for its products.

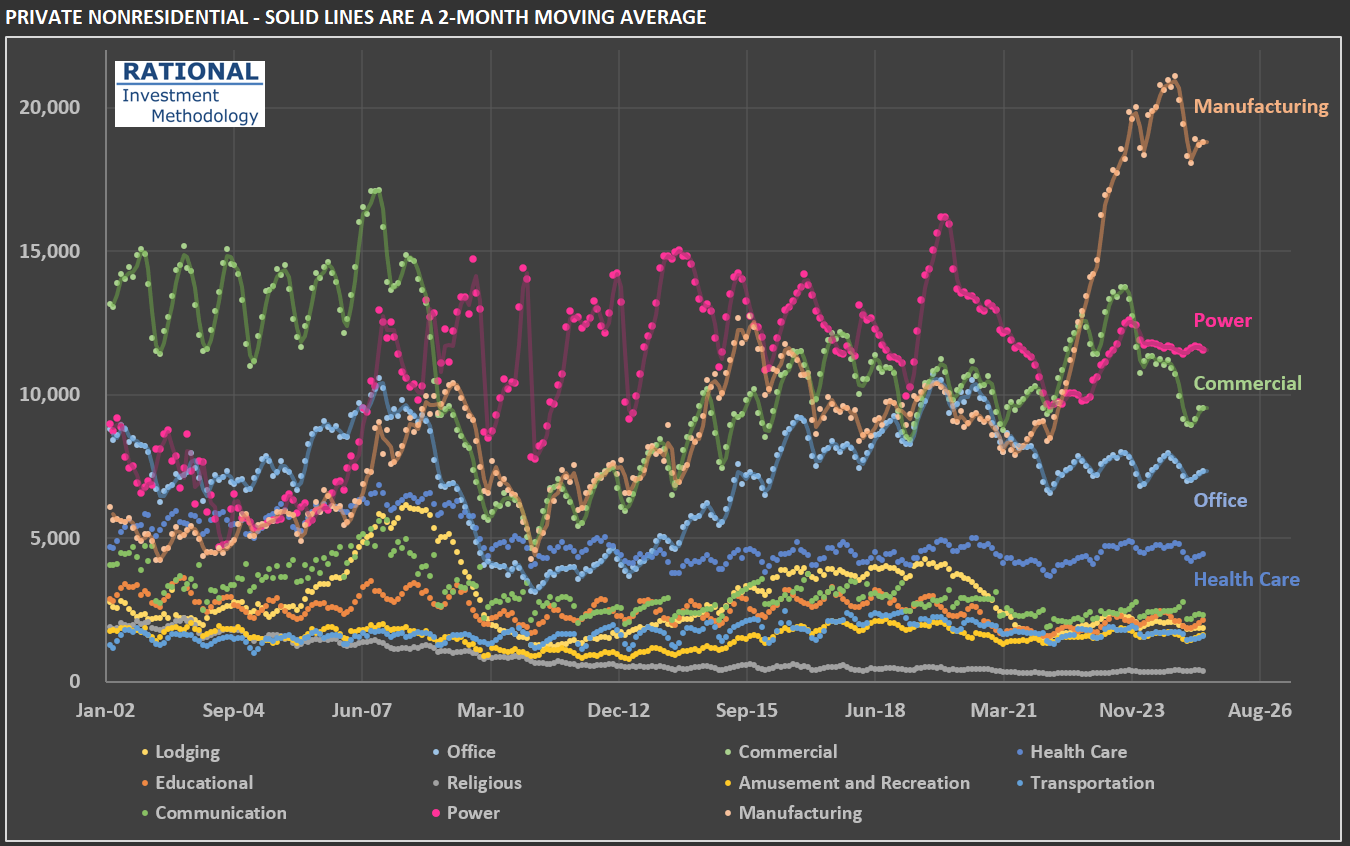

The data, from the US Census Bureau, begins in the early 2000s. The first chart below shows subcategories of a broader category: private non-residential construction. I’m highlighting this first because it reveals the abnormal increase in manufacturing-related construction. Manufacturing spending, measured in millions of dollars per month, doubled from around $10 billion to almost $20 billion per month in just a couple of years[*]. The increase starts in 2022 for a clear reason: the CHIPS and Science Act, the Inflation Reduction Act (IRA), and the Infrastructure Investment and Jobs Act (IIJA) provided substantial federal subsidies, tax credits, and direct funding specifically aimed at boosting domestic manufacturing, particularly in sectors such as semiconductors and clean energy technologies.

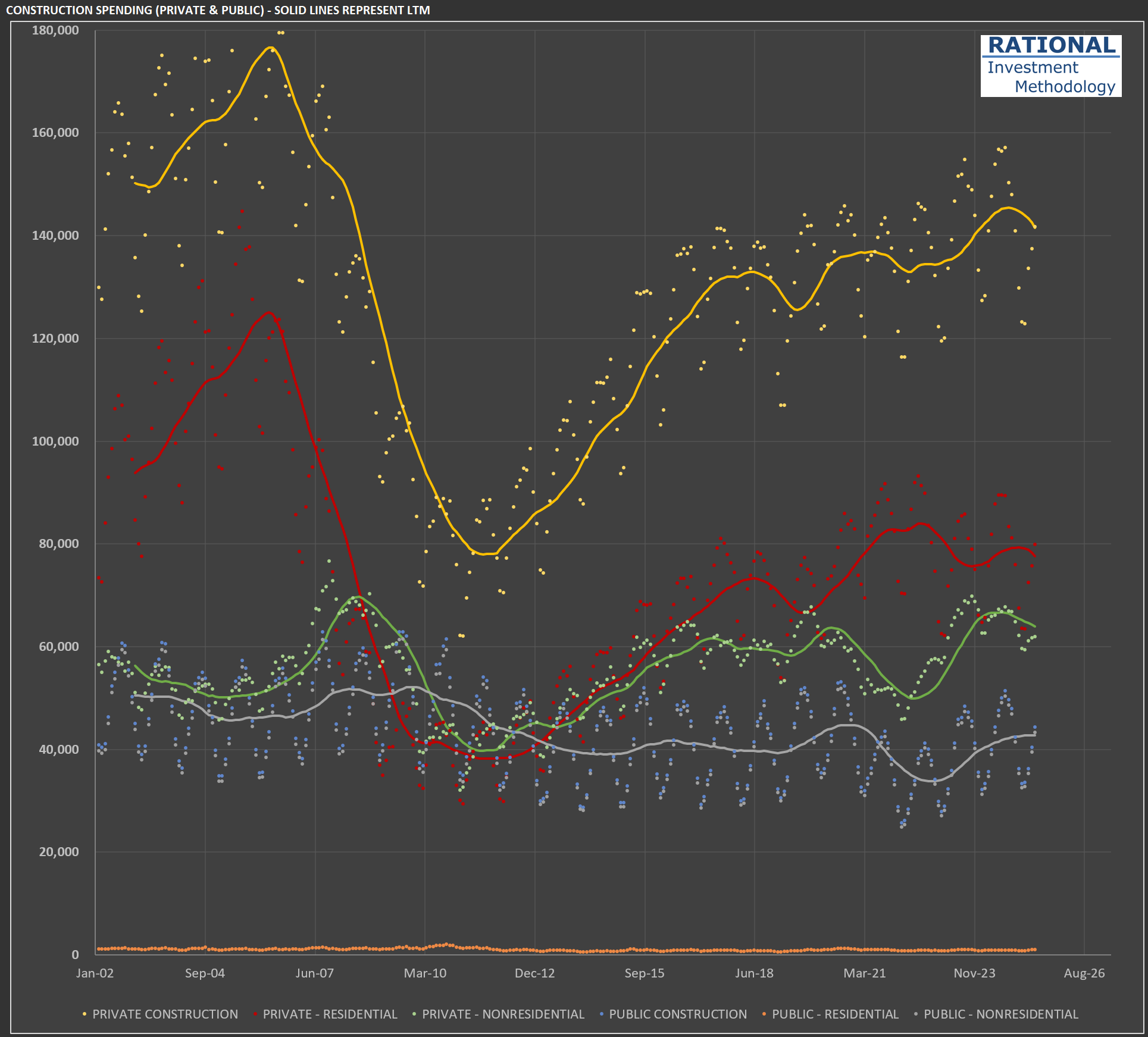

However, it’s essential to put this increase in a broader context, hence the second chart. The green line represents the sum of all private non-residential investments, totaling more than $60 billion per month—a level it has maintained since recovering from the significant decline during the GFC[**]. Notice, however, that private residential construction (in red) is the most prominent subcategory in this chart, with almost $80 billion in monthly spending. When you combine both private-residential and private-nonresidential, you get more than $140 billion in monthly construction spending. The other lines refer to public construction, which is dominated by nonresidential projects (such as highways, sewage, and water treatment). However, this represents a relatively minor component of construction spending, totaling approximately $40 billion per month.

So, is a $10 billion increase in manufacturing-related construction significant? When you combine both private and public spending (totaling around $185 billion), it represents slightly more than 5% of the total. It’s not nothing, but it shouldn’t be the reason for someone to expect a massive increase in construction activity nationwide. The government might intervene even further with additional subsidies. However, the country’s level of debt and current twin deficit should make it more challenging to do so. But we live in times where fiscal restraint appears irrelevant to governments, so time will tell how much more abnormal activity we’ll see in this subsegment of the construction space.

[*] All figures in this chart are adjusted for inflation and population growth [**] Global Financial Crisis