From Shorts to Opportunity: Tracking $SBUX's Turnaround Journey

$SBUX (Starbucks) finds itself in a turnaround phase, and management’s language on the latest conference call was telling. They repeatedly described this as the “early stages of our turnaround in the US”—part of a “multiyear effort” to “rebuild” and get “Back to Starbucks.” When executives use words like “rebuild,” it signals they’re addressing fundamental challenges rather than operating from a position of strength.

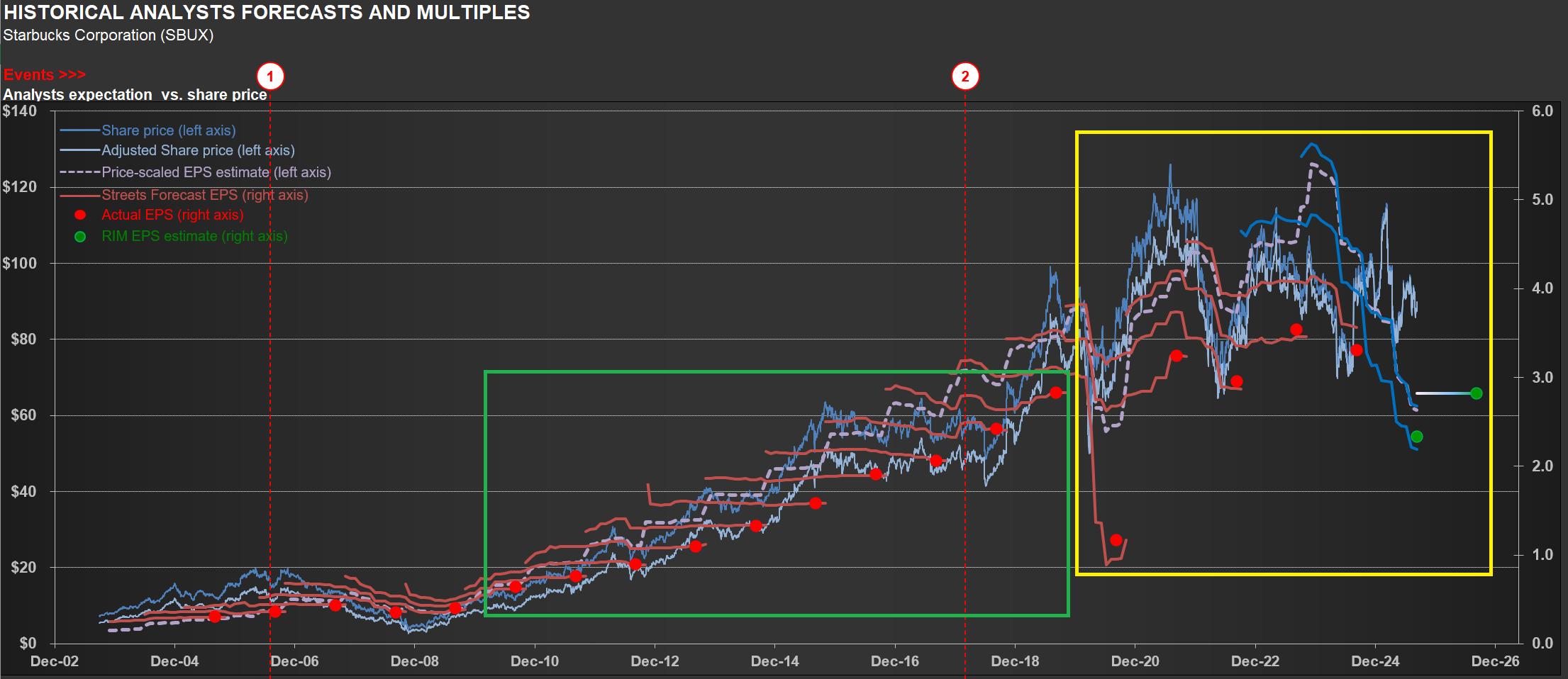

The company’s financials clearly reflect this reality. Take a look at the chart below—one you’ll recognize from my previous analyses. It tracks the company’s earnings versus share price over time. Notice how earnings estimates have become much more volatile recently (yellow rectangle) compared to the pre-pandemic, post-GFC period (green rectangle). While volatility during the pandemic’s peak was understandable, why the continued decline now?

The EPS drop stems primarily from significant operating margin contraction, driven by deleverage and substantial strategic investments in the “Back to Starbucks” initiative. Management describes this as a comprehensive plan aimed at transforming both the business and its culture—ultimately building a stronger, more resilient, and consistently growing company. Chairman and CEO Brian Niccol calls it “the right plan,” grounded in customer and partner feedback and rooted in the company’s core identity as a welcoming coffeehouse serving fine coffee handcrafted by skilled baristas.

But transformation comes with costs. The effort includes over $0.5 billion in additional labor hours for the Green Apron Service rollout and significant spending on Leadership Experience 2025—an event that brought together 14,000 coffeehouse leaders. Will it work? Time will tell, but we should expect continued volatility in earnings expectations along the way.

Here’s what makes this interesting from an investment perspective: if the turnaround succeeds, this volatility could create opportunities to acquire shares at a substantial margin of safety. The last time I owned $SBUX shares was back in 2009. My last three positions on the name were shorts—all successful trades, but that’s the past.

The key question now is whether management can execute on its vision while navigating the inevitable bumps ahead.