Glass Half Full: OI's Strategic Pivot Promises Value Amid Historic Low P/E

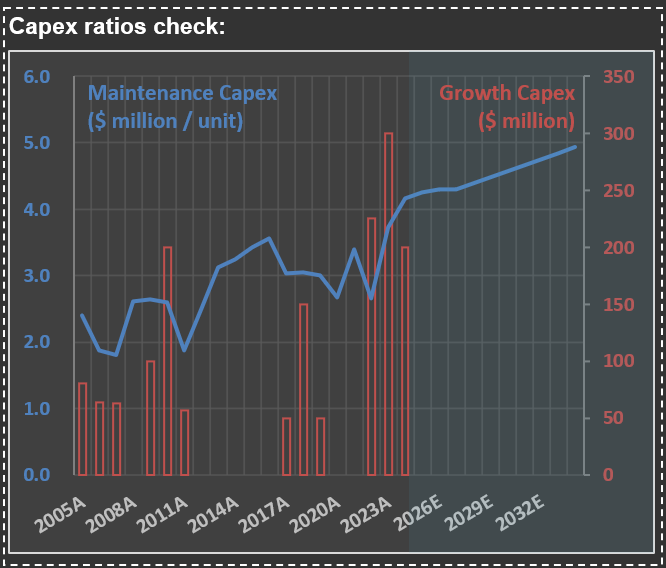

Never underestimate how much money CEOs can burn (and still be paid millions to do so!). Below is my check for Capex for $OI [OI-Glass], the biggest glass containers manufacturer in the world. The company battled massive asbestos liabilities for years. When that got solved, what was the prior CEO plan? Burn almost $1 billion (these are the sum of the two last groups of the red bars) in a new technology called MAGMA.

Here is what the new CEO just said about it: “With regard to MAGMA, we continue to ramp up production at our first greenfield line in Bowling Green, Kentucky. The achievement of key operating and financial milestones at this site over the course of 2025 will be critical as we chart the future of the MAGMA program. As we focus on these milestones at Bowling Green, we have paused the development of Generation 3. As with any capital project, MAGMA will be required to generate returns of at least WACC plus 2%. We will provide more details on our long-term strategic plan next month at our Investor Day.”

In other words, MAGMA didn’t work (as I’m assuming it doesn’t generate returns above WACC). So I will be in New York on March 14th - at the NYSE - to participate on the company’s Investor Day. I hope they will provide information that will increase investors confidence. As of now, if they achieve their $1.45 billion EBITDA guidance for 2017, it means that the company is trading at less than 3x P/E! I don’t use multiples to calculate fair values for companies at RIM. But such a low figure called my attention!