Recreational Boating Market Hits Recession-Era Levels

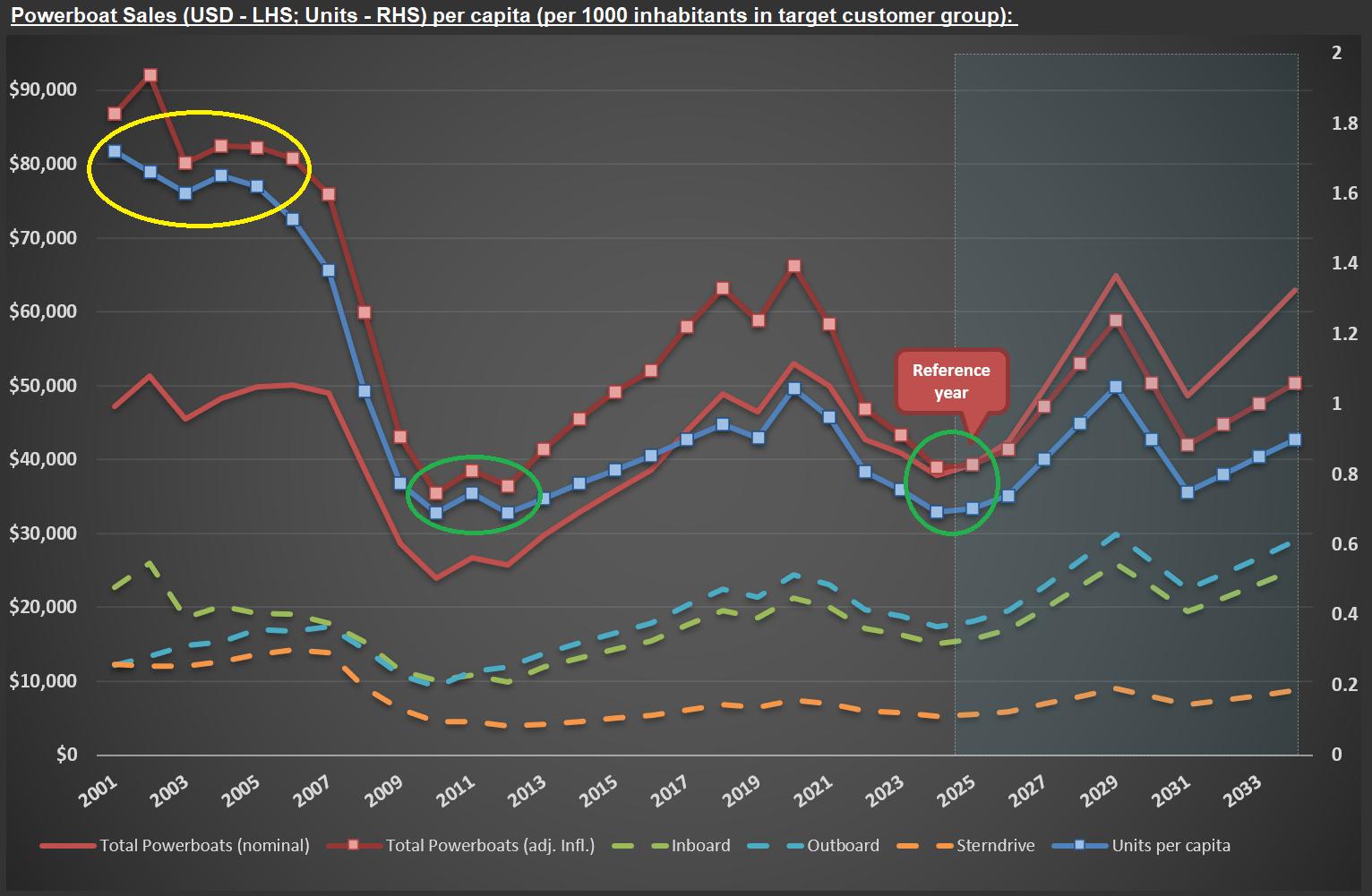

The recreational boating market reveals some concerning trends (which might lead to buying opportunities in the sector). The chart below shows powerboat sales estimates from my $BC (Brunswick) analysis, with the square-marked lines telling an important story. Sales volumes for 2024/2025, measured in units or inflation-adjusted dollars, have retreated to levels we haven’t seen since 2010-2012 – the early recovery period following the Great Recession (circled in green). Even more striking is how these figures compare to the pre-housing bubble era that ended in late 2005 (circled in yellow).

While headline GDP numbers might suggest economic health (I’ll share updated GDP charts and some comments in a future post), the recreational boating industry is experiencing significant challenges. This disconnect between broad economic indicators and sector-specific realities is worth noting for investors.

Brunswick’s recent actions highlight these difficulties. During their Q4 2024 conference call, the CEO candidly shared: “If you look from 1 January 2024 to 31 December, we unfortunately had to exit about 20% of our hourly staff and 7% of our salaried staff. The majority of that happened in the back half of the year when it was clear that we had to reduce our production levels to support year-end inventory levels that we needed to go into 2025.”

What does this mean for the broader discretionary spending landscape? I believe the American consumer is currently in a recession, as comments like the one above - and figures shown in the picture below - don’t show up during a healthy economy. But as always, this too shall pass, and Brunswick and other companies in the sector will revert to normalized sales levels.