Market Prices vs. Fair Value: Why Today’s Quote Isn’t the Full Story

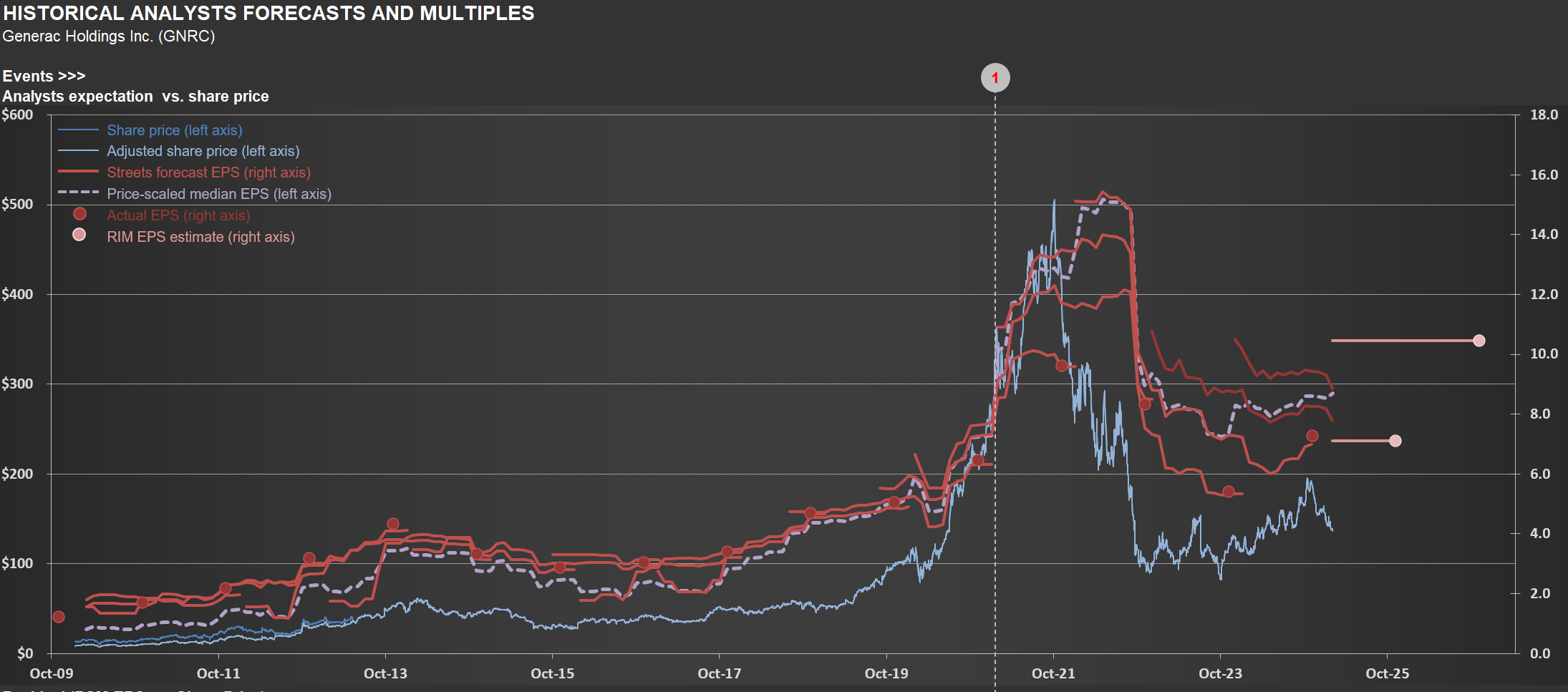

When assessing a company’s long-term value, certain metrics can be misleading—and today’s share price often tops the list. Take $GNRC [Generac] as an example. Since its IPO, short-term earnings estimates (red lines in the first chart below) have closely tracked its share price (blue line). While markets are “correct” on average over time, valuations at any given moment frequently stray far from rational estimates of fair value.

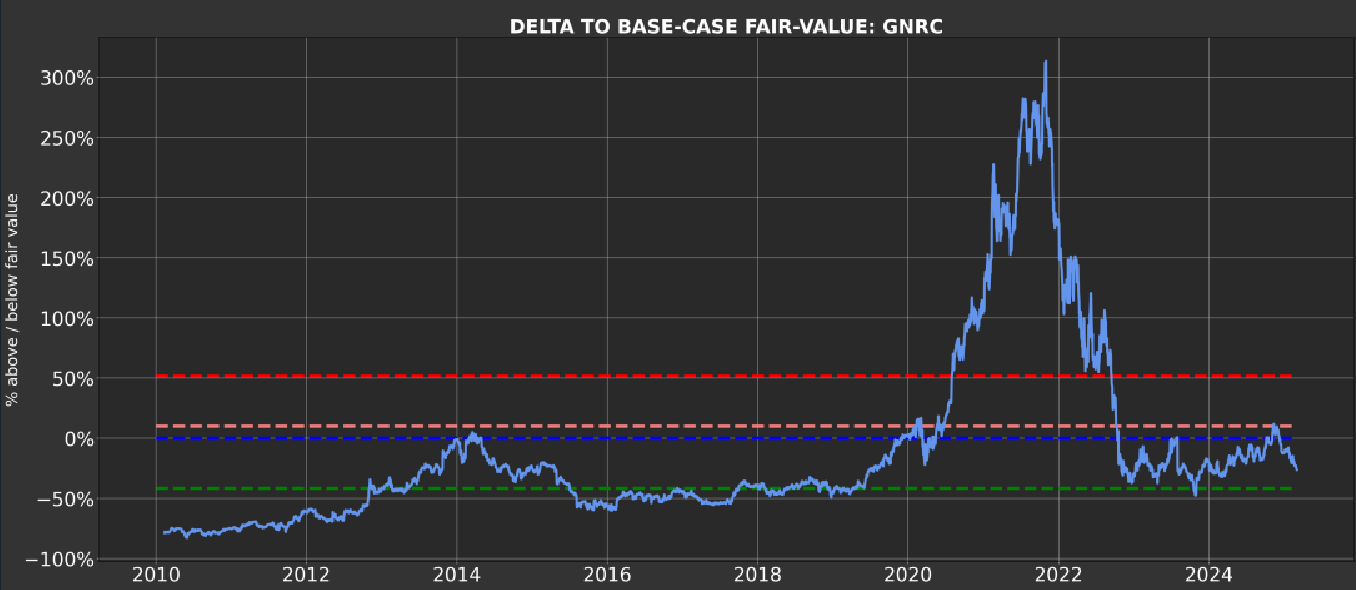

The second chart, from Odysseus (RIM’s portfolio management tool), highlights this disconnect. The blue line shows the market price deviation from RIM’s fair value calculation. At $500/share in late 2021, Generac traded at a staggering 300% premium to its intrinsic value—a vivid reminder that asking “what is the market telling me?” can lead to flawed conclusions.

Key Takeaways:

- Extreme price deviations are common, driven by short-term sentiment rather than long-term fundamentals.

- Systematic strategies thrive on these dislocations, using disciplined triggers to enter long/short positions.

- RIM’s approach focuses on exploiting these gaps rationally, avoiding emotional reactions to market noise.

By anchoring decisions to intrinsic value—not fleeting price swings—investors can turn volatility into opportunity.