Farm Cash Flow: The Hidden Driver of Agricultural Equipment Sales

As I delve into my $AGCO [AGCO Corporation] analysis today, I’m reminded of the fascinating relationship between farm economics and agricultural equipment sales. The agricultural sector’s financial health, particularly U.S. farm cash receipts (or net cash income), has historically been a key indicator of agricultural capital expenditures.

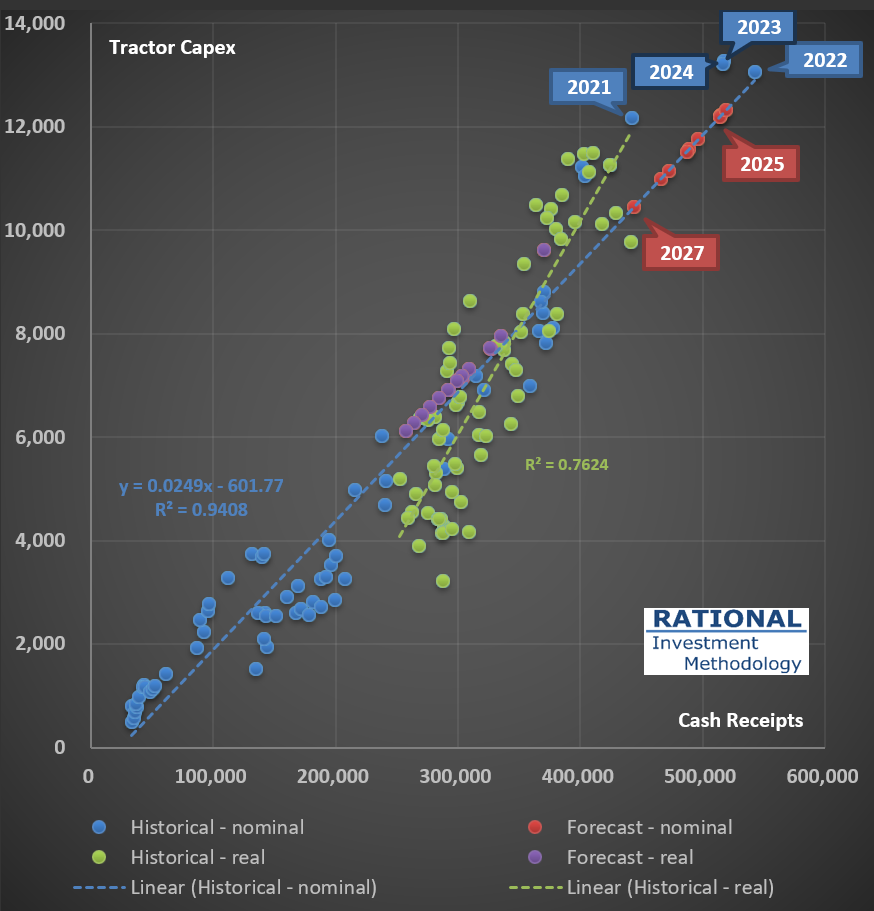

Take a moment to examine the first chart below. It beautifully illustrates the strong correlation between tractor sales and cash receipts, highlighting the direct impact of farm profitability on equipment purchases.

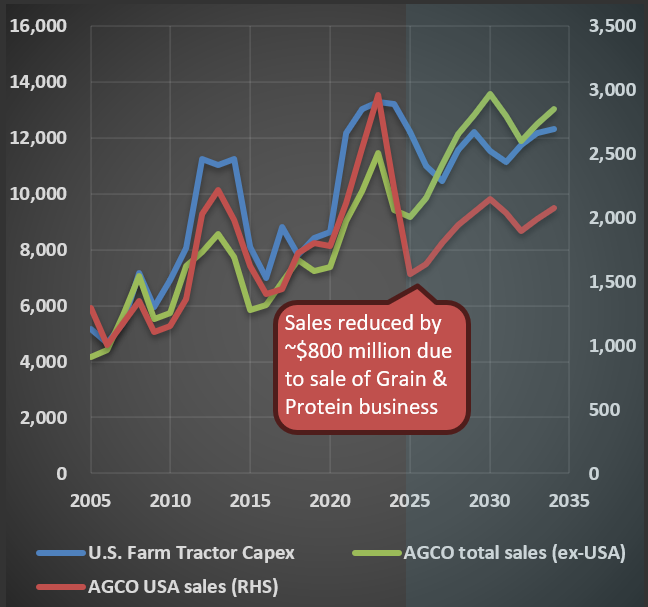

Even more intriguing is how we can use U.S. farm cash receipts as a proxy for global trends. Despite AGCO and other agricultural equipment companies operating on a global scale, the interconnected nature of agricultural commodity markets allows for this simplification. The second chart demonstrates this phenomenon, showing remarkably similar sales dynamics between U.S. and non-U.S. regions.

In my forecasting work, which includes $DE [Deere & Co.], I’ve found the USDA’s projections of U.S. farm cash receipts to be invaluable for predicting long-term revenue trends in the agricultural equipment sector. This approach has consistently yielded accurate results, providing a solid foundation for investment decisions.