Are Investors Overpaying for Growth? O'Reilly's SSS Under the Microscope

When analyzing retailers' sales, it is necessary to adjust “same-store sales” (SSS) by the age of the square footage. This adjustment is required because newer stores typically generate lower sales per square foot than established locations, as it takes time for customers to discover and frequent newly opened convenient locations.

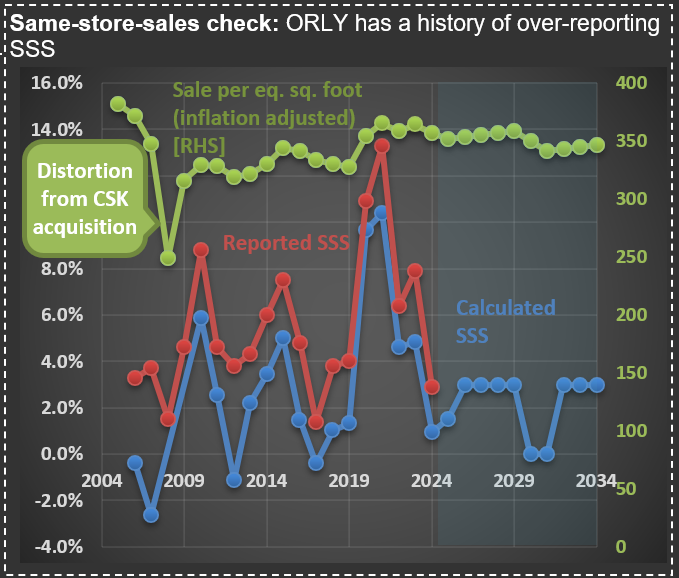

Without these adjustments, there’s a significant risk of overestimating actual sales growth. In my analysis of $ORLY (O’Reilly Automotive), I’ve consistently calculated lower growth figures than what they’ve reported for several years now. As you can see in the picture below, ORLY’s reported figures (red line) consistently outpace the properly adjusted metrics (blue line).

Over the past two decades, ORLY has reported impressive average SSS growth of 5.6% annually. However, my calculations suggest they’ve overestimated this growth by approximately 2.9% per year. This means their true SSS growth rate is closer to 2.7%—essentially tracking with inflation.

This discrepancy may have contributed to ORLY’s current valuation, which stands at more than 30x earnings. At today’s price, an investor is accepting a potential return of only about 5.5% annually (from a business owner’s perspective, similar to how Warren Buffett would evaluate a complete acquisition). Is such a modest return sufficient for your investment goals?