What Harley-Davidson's Financing Data Reveals About the US Consumer

$HOG (Harley-Davidson) operates as two distinct businesses: a motorcycle manufacturer and a consumer financing provider. In fact, Harley-Davidson Financial Services financed over 70% of the motorcycles sold in 2024. Like any company offering financing, it must set aside provisions for potential credit losses.

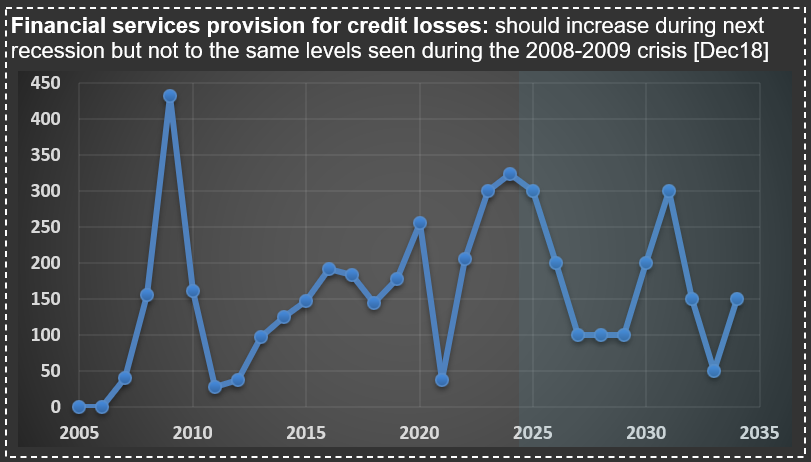

The chart below illustrates these credit loss provisions (in basis points) relative to their total outstanding receivables portfolio. Notice the significant spike in 2009 during the Great Financial Crisis (GFC)—a severity that’s tough to surpass. (You might also spot my 2018 comment, noting future cycles would come, though likely not as extreme as the GFC.)

But more importantly, observe how elevated these provisions have been over the past two years (and likely continuing into 2025). Those surprised by recessionary signals today simply haven’t been paying attention to the right indicators. As I’ve mentioned in previous posts, the US consumer has already exhibited recessionary behavior for some time.