Fundamental Analysis Spotlight: $OI and Market Mispricing

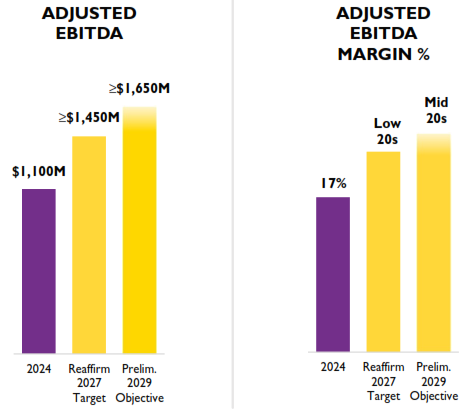

I attended the $OI (OI-Glass) investor day event and wanted to share some interesting insights. Look at the first chart below, which I pulled from their extensive 91-page presentation. Notice the projections for 2029: management targets EBITDA margins in the “mid 20s,” so let’s call it “around 25%.”

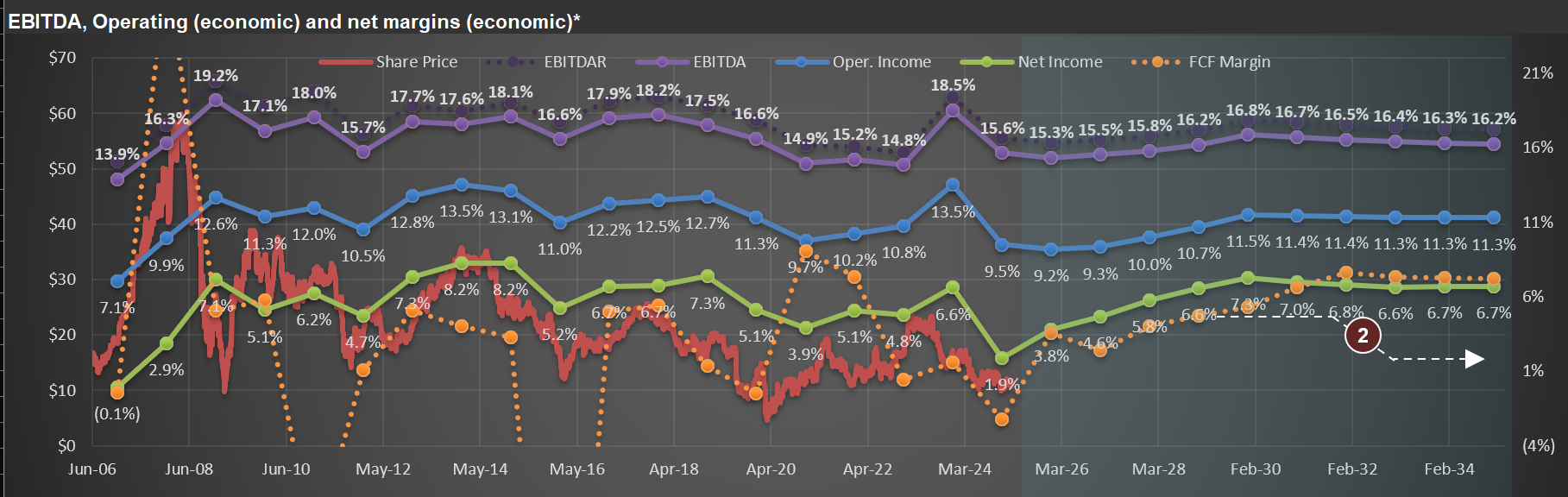

Now, check out the second image—this one shows my base-case scenario for OI-Glass. By 2029, my estimated EBITDA margin stands at 16.8%. I’m slightly more conservative in calculating EBITDA than management, as I leave some expenses on my calculations that they might exclude. So let’s round up my estimate to 17%.

But here’s the impressive part: OI-Glass appears substantially undervalued even using my conservative margin of 17% (or 8 percentage points below management’s target). Historically, the market has valued companies similar to OI-Glass—assuming my base-case scenario—at around 4 to 5 times today’s valuation. It would be much more with EBITDA margins of 25%!

This is a perfect illustration of market inefficiencies. The market isn’t fully pricing future profitability improvements implied by OI-Glass management’s expectations. Instead, share prices often reflect current EPS disproportionately. This is precisely where fundamental analysis adds value. If you’re skilled at (and have the time to dedicate to) understanding businesses and accurately forecasting long-term earnings potential, you’ll be well-positioned to identify opportunities (long or short) that eventually get recognized by the Market’s mechanical pricing heuristics.

Hence, I focus on first understanding what companies do and in which context (e.g., their competitive environment). Only after that do I spend time modeling a company in excruciating detail (also a necessary step to quantify your understanding of the business). With such an approach, I hope to be an “investor” and not a “speculator " (who blindly hopes that share prices move in their favor).