$SEE’s Product Care Segment: A Warning Sign and The Market's Overreaction

$SEE (Sealed Air) is a name you’re likely familiar with, even if you don’t realize it. They’re the company behind Bubble Wrap—the iconic packaging material that’s as fun to pop as it is practical. Beyond Bubble Wrap, SEE provides materials and machines that streamline packaging processes across industries. If you’ve purchased food or products recently, chances are they were packaged using SEE’s solutions. You can find more examples of their offerings on their website.

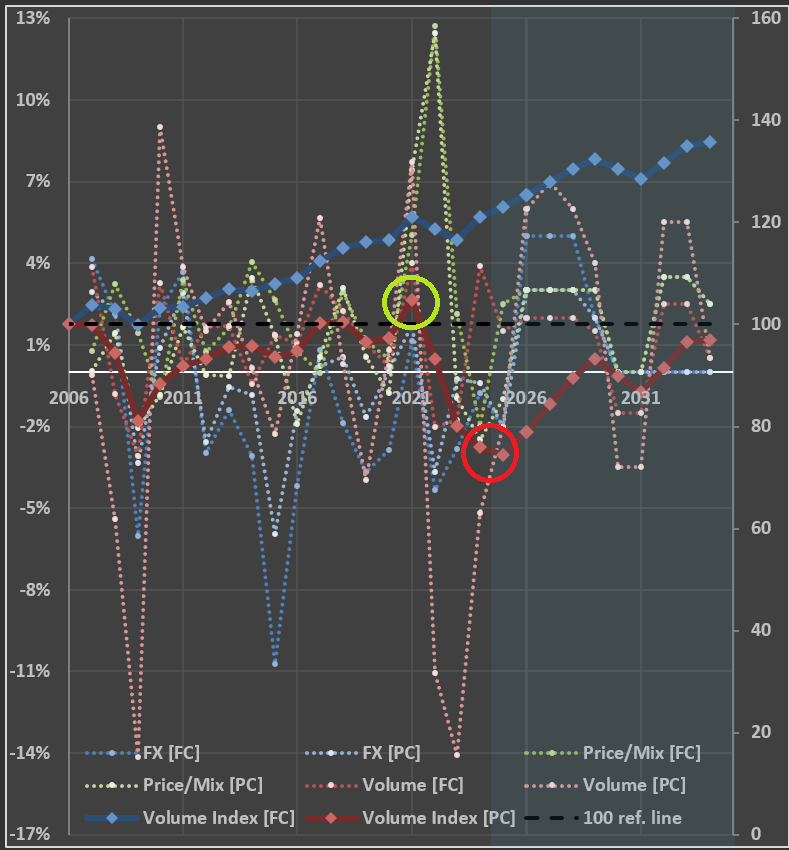

Take a look at the chart below, which breaks down key metrics for SEE’s two segments: Product Care [PC] and Food Care [FC]. The dotted lines represent the impact of volume, price, and foreign exchange (FX) on sales. Meanwhile, the solid lines show cumulative volume indices for both segments (2006 = 100).

The blue line for Food Care reflects stability—no major surprises there. But the dark red line for Product Care tells a different story. After recovering from the lows of 2009, there was a modest uptick in 2021 (highlighted by the green circle), driven by pandemic-era stimulus. However, the red circle draws attention to concerning figures for 2024 and projected 2025. The index for Product Care volume is around 75—25% below its 2006 level (two decades ago) and even lower than the 81 seen in 2009.

This decline raises important questions. Packaging products and equipment is undoubtedly a competitive space, but SEE remains a key player in the industry. The drop in Product Care volume seems less likely to stem from a sudden loss of market share and more likely to signal broader economic trends—perhaps another indicator of a consumer recession. Despite this, the market appears to have punished SEE’s valuation, focusing narrowly on its current depressed earnings per share (EPS). Could this reaction be overly pessimistic?