Navigating Cycles: Insights from $OLN’s Volatile Industry

Today, I’m analyzing $OLN (Olin), a company specializing in chlorine, caustic soda, vinyls, and other chlorinated organics, as well as epoxy materials and their precursors. The charts below illustrate the challenges of operating in a cyclical industry—and what that means for investors.

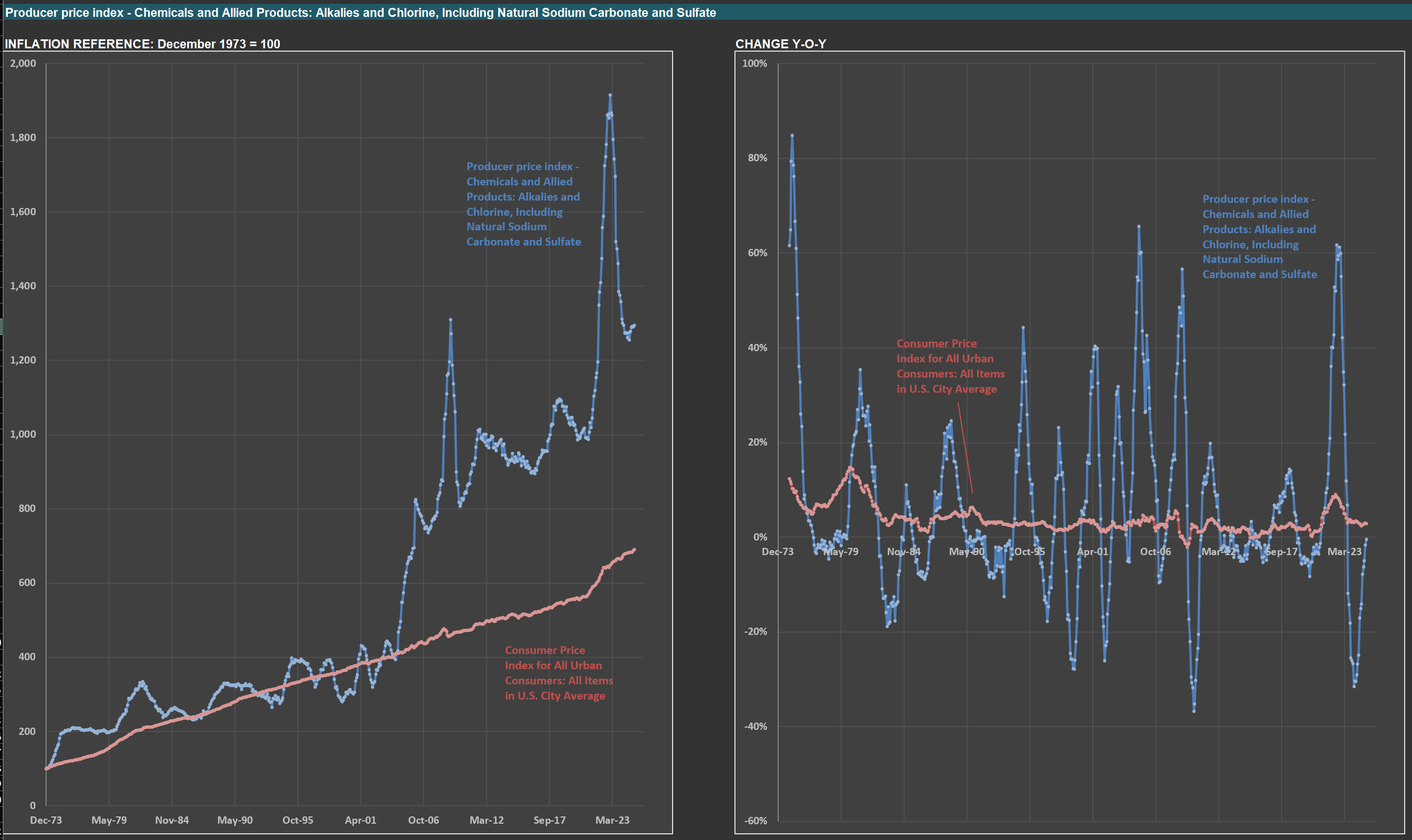

On the left, you’ll see a price index for alkalies and chlorine (in blue), $OLN’s core product category, alongside a broad consumer price index (in red). On the right, the year-over-year changes for both series are displayed. The stark variability in commodity prices compared to broader price indexes is evident. The most recent spike was driven by two factors: heightened consumption during the pandemic—fueled by oversized government stimulus—and a fire at a major U.S. plant producing similar chemicals.

This volatility highlights how challenging it is to manage a business in such an environment. For investors, however, there’s an upside. These sharp price and volume swings can significantly impact $OLN’s profitability, leading to fluctuations in EPS and stock prices. For those willing to put in the work, these cycles create opportunities to buy or sell with a meaningful “margin of safety.” Of course, understanding these dynamics requires careful analysis and a great deal of patience.