From Pizza to Tesla: When Founders Shape—and Shake—Brands

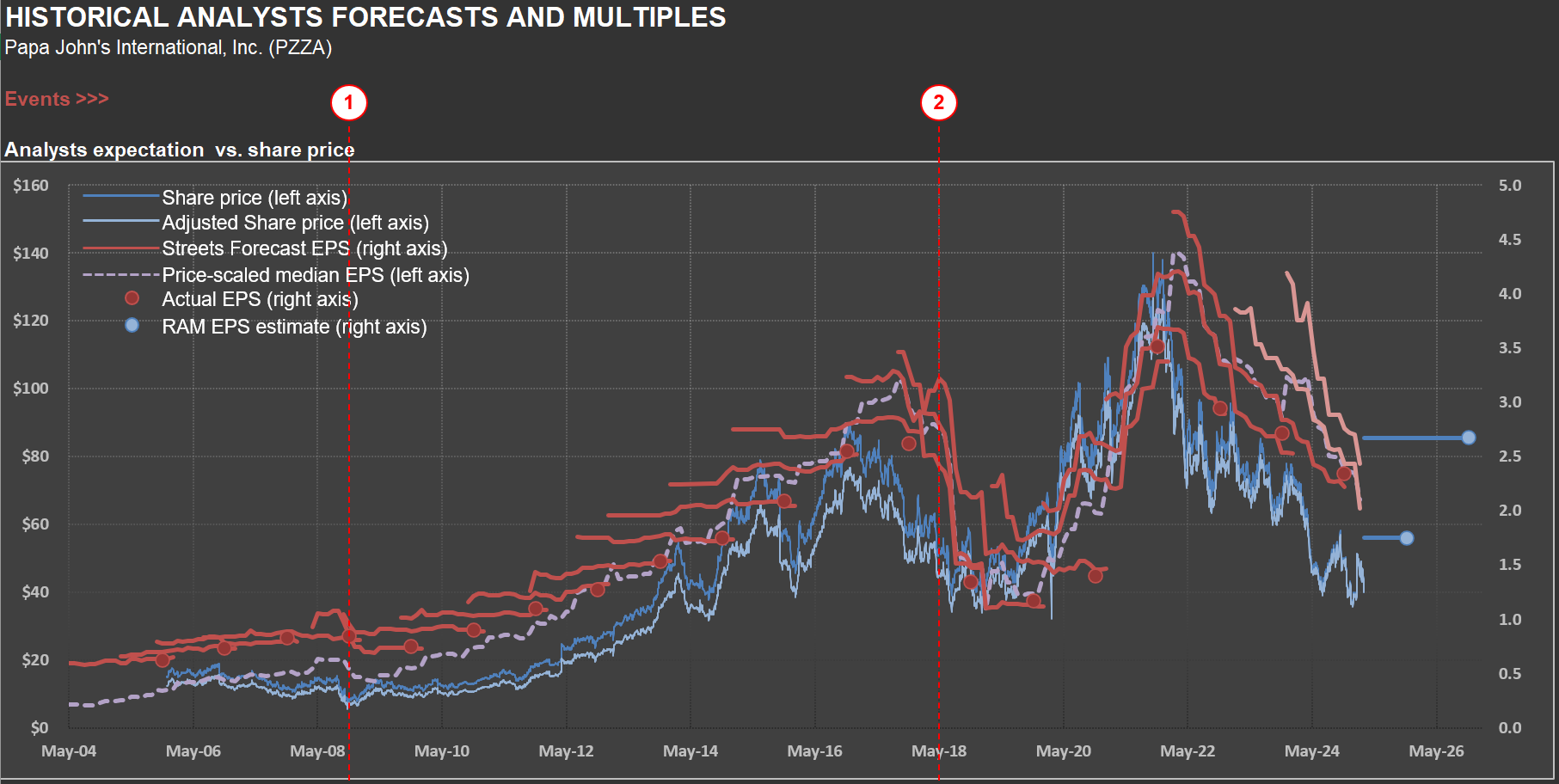

Every time I’m tempted to think a company has a straightforward business model, I revisit my analysis of $PZZA (Papa John’s). Selling pizza might seem simple, but the story behind this company proves otherwise. Below is a chart familiar to those who follow RIM’s approach, showing the correlation between share price and average sell-side analyst estimates. I’ve previously discussed how market prices are often biased by short-term EPS projections here.

Papa John’s earnings over the past decade have been anything but steady. The company was coming off a strong growth phase when its founder and former CEO, John Schnatter, made racially insensitive remarks during a May 2018 conference call. This scandal, revealed in a July Forbes article, triggered widespread backlash. Schnatter’s image was swiftly removed from the company’s branding and advertisements. Just days later, Forbes published another article detailing allegations of sexual harassment within Papa John’s offices. On the same day, Wendy’s announced it would not pursue a potential merger with Papa John’s.

Event #2 on the chart highlights the month leading up to these revelations. Sales plummeted, dragging earnings—and share prices—down with them. The company faced an uphill battle to distance itself from Schnatter’s legacy when an unexpected twist changed its fortunes: the pandemic. As restaurants closed nationwide, pizza delivery became one of the few ways people could enjoy prepared meals at home—a small slice of normalcy for many during uncertain times. Sales surged, margins improved, and EPS hit new highs. The founder’s scandal faded into history.

Fast-forward to today: Papa John’s is grappling with more challenges. Sales are normalizing after their pandemic peak, and the broader consumer environment remains weak—something I’ve touched on in recent posts about the recessionary pressures facing American consumers. Even for a seemingly simple business like pizza, there’s no such thing as “normal.”

This brings me to $TSLA (Tesla) and Elon Musk—a case study in what might be called “key man risk” on steroids. Much like Papa John’s in 2018-2019, Tesla is deeply tied to its founder’s vision and personality. Founders often drive rapid growth because they care deeply about their creations. But when their actions alienate customers—whether justified or not—the fallout can be significant. From pizzas to electric cars, businesses are far more intricate than they appear at first glance. And when emotions start influencing a brand, complexity grows exponentially.