Housing Starts: The COVID-19 Blip and What Comes Next

As I work on valuations for $HD (Home Depot) and $LOW (Lowe’s), I regularly update my broader analysis of the housing sector. While I have a wealth of charts on this topic, including all of them in one post would make it far too lengthy. For now, I’ll share just a couple of key charts—more will follow in future posts.

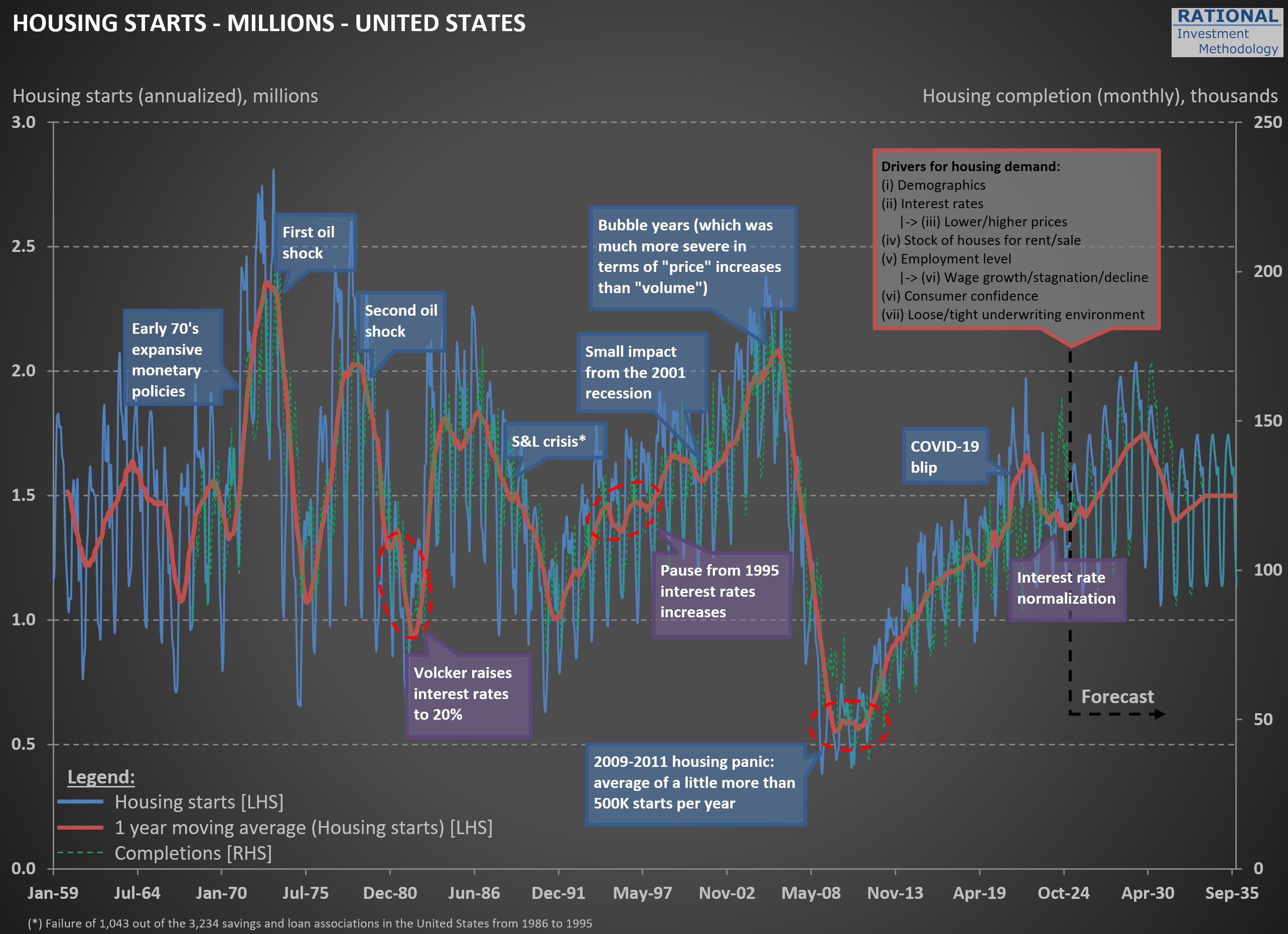

The first chart below is one of the earliest I created on this subject, dating back nearly 20 years. It tracks U.S. housing starts at an annualized rate, calculated by multiplying monthly figures by 12. Housing starts in the United States exhibit significant seasonal variation, particularly in regions with harsh winters. To smooth this out, the red line represents a 1-year moving average.

Take a moment to review the annotations on the chart—they highlight major economic events over time. Notably, every significant economic crisis in the U.S., with the possible exception of the 2001-2002 recession, has either originated in or been closely tied to the housing sector. The most recent event marked is what I call the “COVID-19 blip,” when zero interest rates and aggressive stimulus measures triggered a surge in new home construction.

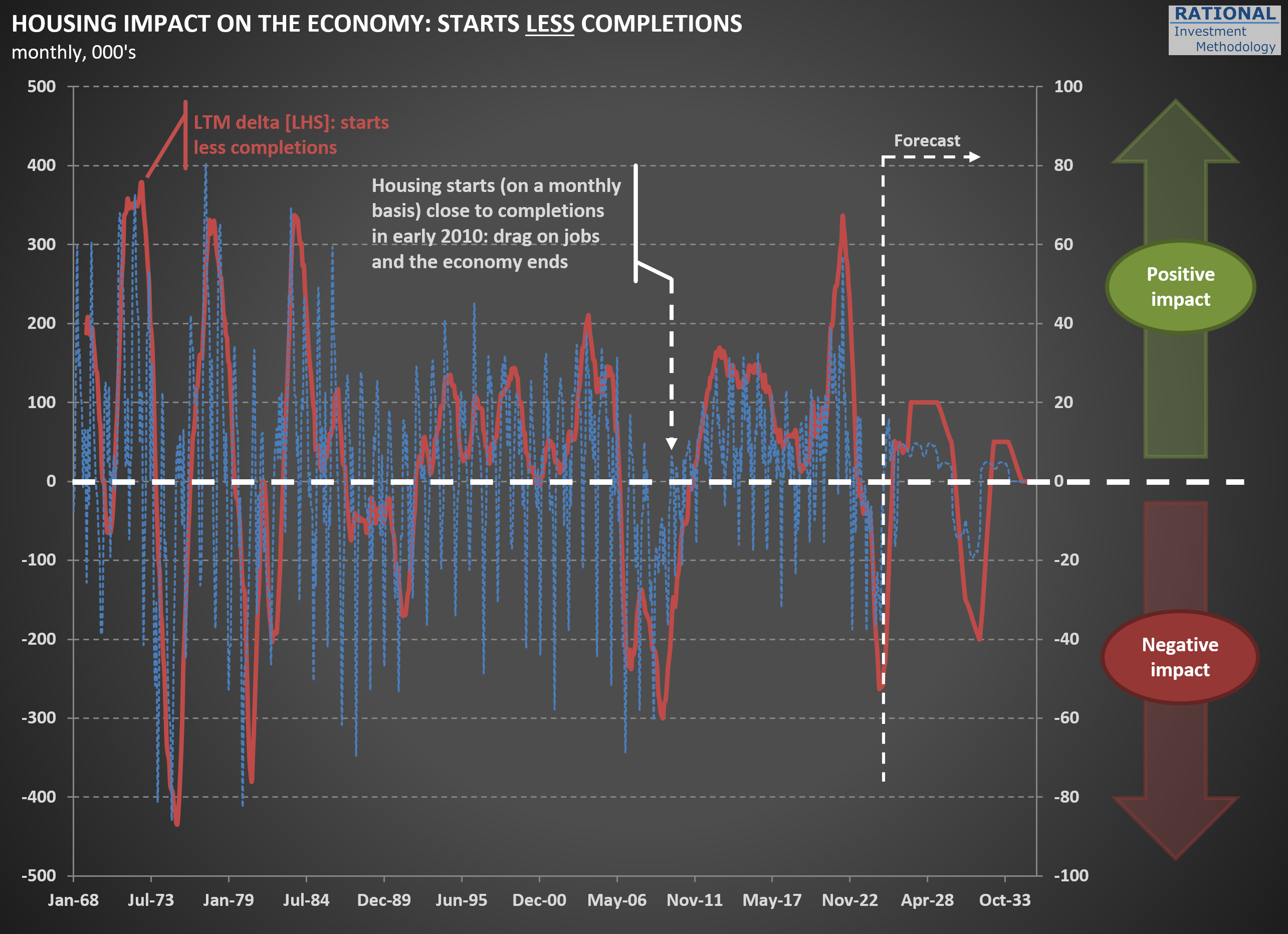

The second chart illustrates one of the unintended consequences of this “blip.” The blue line represents housing starts minus completions, while the red line shows a 12-month cumulative total (scale on the left). What stands out is that we’ve just come through a period where more houses were being completed than started.

In 2024 alone, approximately 250,000 more homes were completed than initiated. This mismatch has had ripple effects across numerous companies tied to RIM’s CofC (Circle of Competence), particularly those in the building materials sector, which have reported weak or declining sales as a result.

Here’s where it gets interesting: as discussions about a potential recession heat up, this particular drag on the economy is nearing its end. By April 2025 (yes, tomorrow!), the blue line is expected to turn positive again. This shift will remove one of the most significant headwinds for the economy, given housing’s outsized influence on overall economic activity. To be clear, this doesn’t mean we’re on the cusp of another housing boom—but it does suggest that the lingering effects of the “COVID-19 blip” will finally fade.

That said, history suggests that boom-bust cycles in housing are far from over. So, while this particular drag may be dissipating, don’t get too comfortable assuming stability in this sector—it’s always full of surprises.