Railcar Manufacturing: Why 2025 Forecasts Are Pointing Down

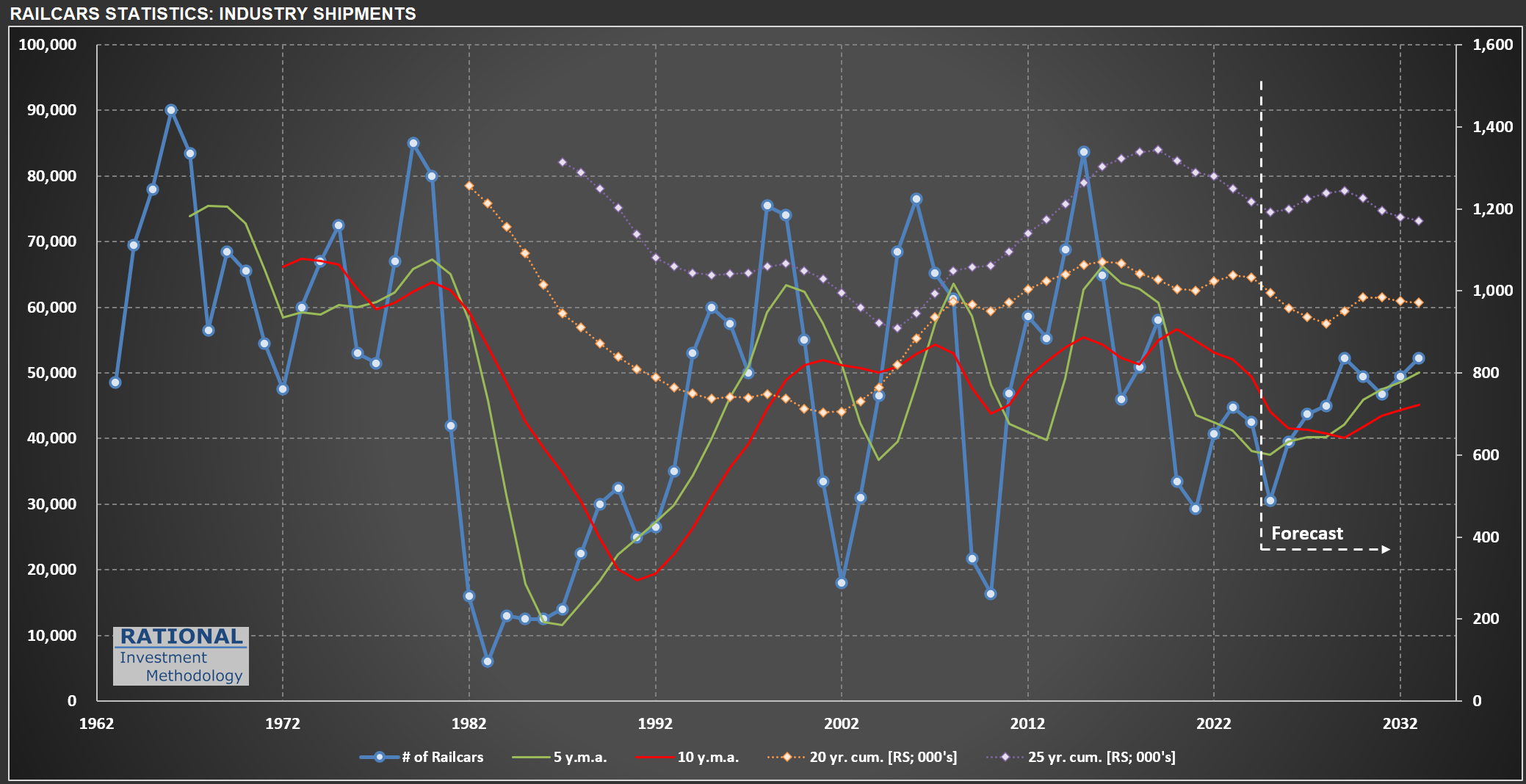

It always amazes me how volatile railcar manufacturing in the US can be. The chart below tracks railcar deliveries (blue line), with additional lines representing moving averages and cumulative deliveries over different periods. This data is from my ongoing analysis of $TRN (Trinity Industries), which manufactures, leases, and manages freight and tank railcars for sectors like agriculture, energy, construction, and consumer products.

If you look at the chart, you’ll notice that the first forecast year (2025) shows a substantial decline compared to 2024. This drop is based on the midpoint of TRN management’s guidance for 28,000 to 33,000 deliveries in 2025-a figure released on May 1, 2025, after recent tariff changes had already taken effect. For context, just a few weeks earlier-in February-Greenbrier (TRN’s main competitor) projected 38,000 industry-wide deliveries for the year.

So, why the nearly 20% drop in expected units? TRN’s management addressed this on their last conference call:

“Market uncertainty in the first quarter continued to slow conversion of inquiries to orders… Inquiry levels at the beginning of 2025 were the highest they’ve been in several years. But customers are taking longer to make capital decisions… We delivered 3,060 new railcars in the quarter and received orders for 695 railcars, evidence of the delayed investment decisions I have previously acknowledged and the lumpiness of orders quarter-to-quarter.”

This is a familiar pattern: when policymakers make abrupt changes to the rules, companies often pause before making new investments. Most CEOs and decision makers prefer to wait for clarity before committing to capital expenditures. Consumers can behave similarly. I expect to post more evidence here in the future about the noise created by the recent economic shifts we’re seeing in the US. Some of these changes may prove beneficial over time, but the probability of a short-term slowdown has clearly increased.