Consumer Confidence and RV Sales: Insights from Thor Industries ($THO)

I just finished updating my analysis of $THO (Thor Industries), the largest manufacturer of RVs (Recreational Vehicles) in the US. The U.S. RV market is dominated by a few major players, often called the “Big 3”: Thor, Forest River (a Berkshire Hathaway company), and Winnebago, an iconic name in the RV world.

Thor’s management shared in their latest earnings release that retail demand has generally aligned with expectations, despite some challenges in the first half of FY25 (August 2024 to January 2025). While there was improvement in the second half, it was less than initially anticipated, prompting a revision of prior guidance. The slight increase in consumer confidence in May 2025 is a positive sign for retail demand through the end of FY25 (July 2025). However, aggressive tariff policies could weigh on demand in the latter half of the calendar year if their impact on Average Sales Prices (ASPs) is not effectively managed industry-wide. They also expect the first quarter of fiscal 2026 (June to August 2025) to be challenging.

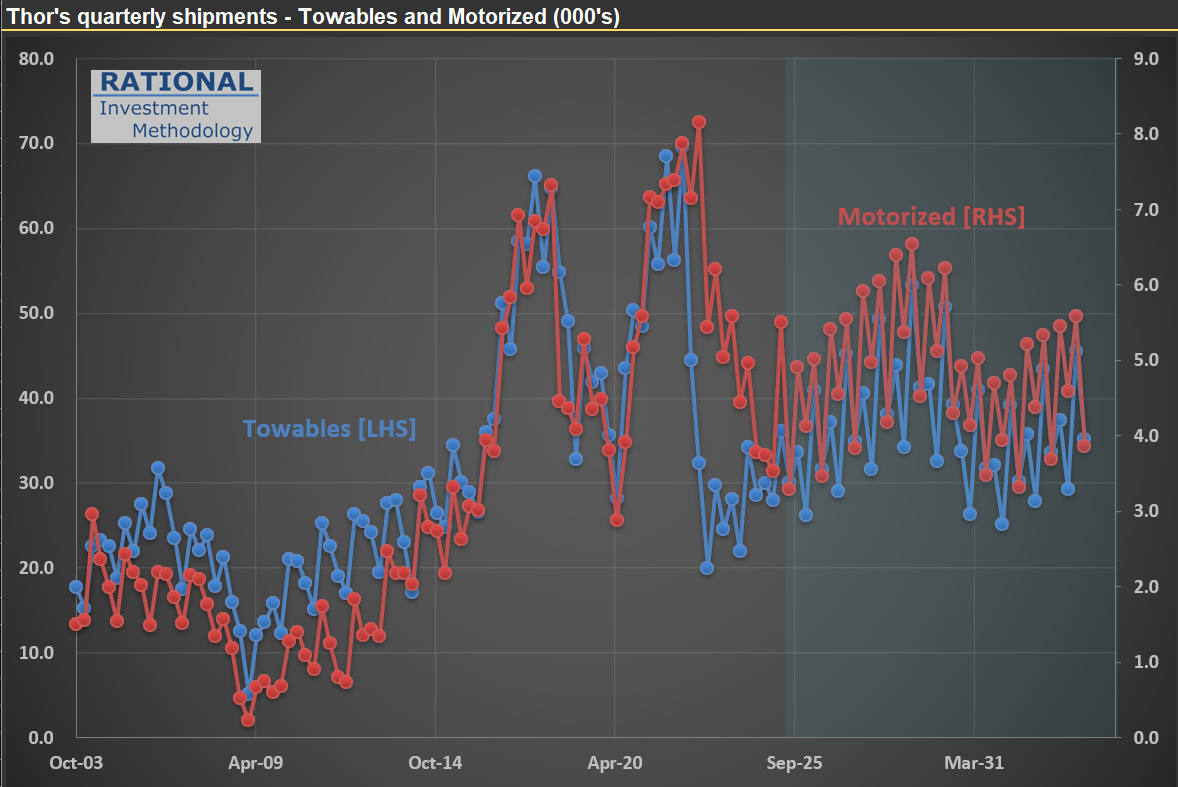

The main reason for this cautious outlook? Tariff uncertainties. Now, consider that Thor has already been navigating significant fluctuations in demand—see the picture below. The blue line illustrates quarterly deliveries in their “towables” segment, the company’s largest. Imagine running a production line that must handle between 20,000 and 70,000 units every three months, without knowing in advance when demand will be strong or weak.

Thor sells highly discretionary products—you don’t really need an RV! Because of this, their sales levels serve as a strong indicator of real consumer confidence. I’ll be watching their numbers closely as we move through what remains an unnecessarily volatile economic and operational environment.