$FLS Share Price Surge: Nuclear Hype Meets AI Mania

This past week, $FLS (Flowserve Corporation) released earnings that clearly illustrate how the AI race and associated mania can spill over into even traditional companies, particularly in the industrial sector. Flowserve is a classic industrial company that sells technical equipment to its corporate clients. It specializes in precision-engineered equipment that manages the movement, control, and protection of industrial fluids and gases in critical infrastructure applications. The company operates through two primary business segments: the Flowserve Pumps Division (FPD), which focuses on highly custom-engineered pumps, and the Flow Control Division (FCD), which designs, manufactures, and services industrial valves.

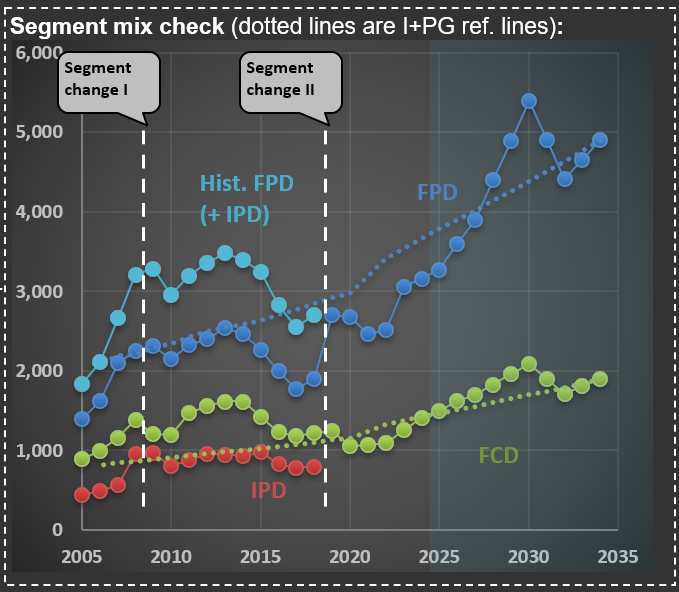

The first chart shows sales over the two main segments. But you can also see a line that ends abruptly—that is their IPD (Industrial Products Segment; the red dotted line in the chart), which was merged into FPD. It isn’t uncommon for companies to change segments—Flowserve did so twice in the past 20 years. I find it challenging when this happens, as it makes it harder to track the progression of sales and margins over the years.

A case in point is what happened when they released their earnings for 3Q 2025. Shares jumped more than 30%. This is more than three times what was observed during earnings releases when the company surprised the market positively over the past decade. The reason: the focus on nuclear energy. At the end of the post, you see the cover of their earnings release presentation—that is a nuclear power plant.

The word “nuclear” was mentioned 25 times in its earnings presentation and 59 times during the conference call transcript. And the market was excited with phrases like “we believe that nuclear flow control opportunity set could be $10-billion-plus over the next decade,” pushing share prices up abnormally. Now, do you know how much nuclear-related sales Flowserve has? They sold $160 million in pumps and valves in 2024, somewhat related to nuclear facilities. This is 3.5% of their sales (of $4.6 billion). So, do you think that a company that isn’t relevant in the nuclear space should increase in value by more than 30% because they mentioned the word “nuclear” in their earnings release?

Because of AI’s high electricity consumption, there is widespread speculation that countries like the US will reignite their nuclear power programs. First, a long-term renewed interest in nuclear energy is already a speculative assumption. Second, nuclear facilities construction takes years (usually measured in decades) to complete. And even if it does happen, the chances of Flowserve meaningfully participating are small.

The mere mention of a word in a release leading to significant share price appreciation reminds me of 1999, when companies were adding “.com” to their names and instantly increasing in value. What happened with Flowserve might be something similar. A company that only tangentially touches the nuclear space increased its valuation by disproportionately associating itself with this field. This is what a mania looks like.