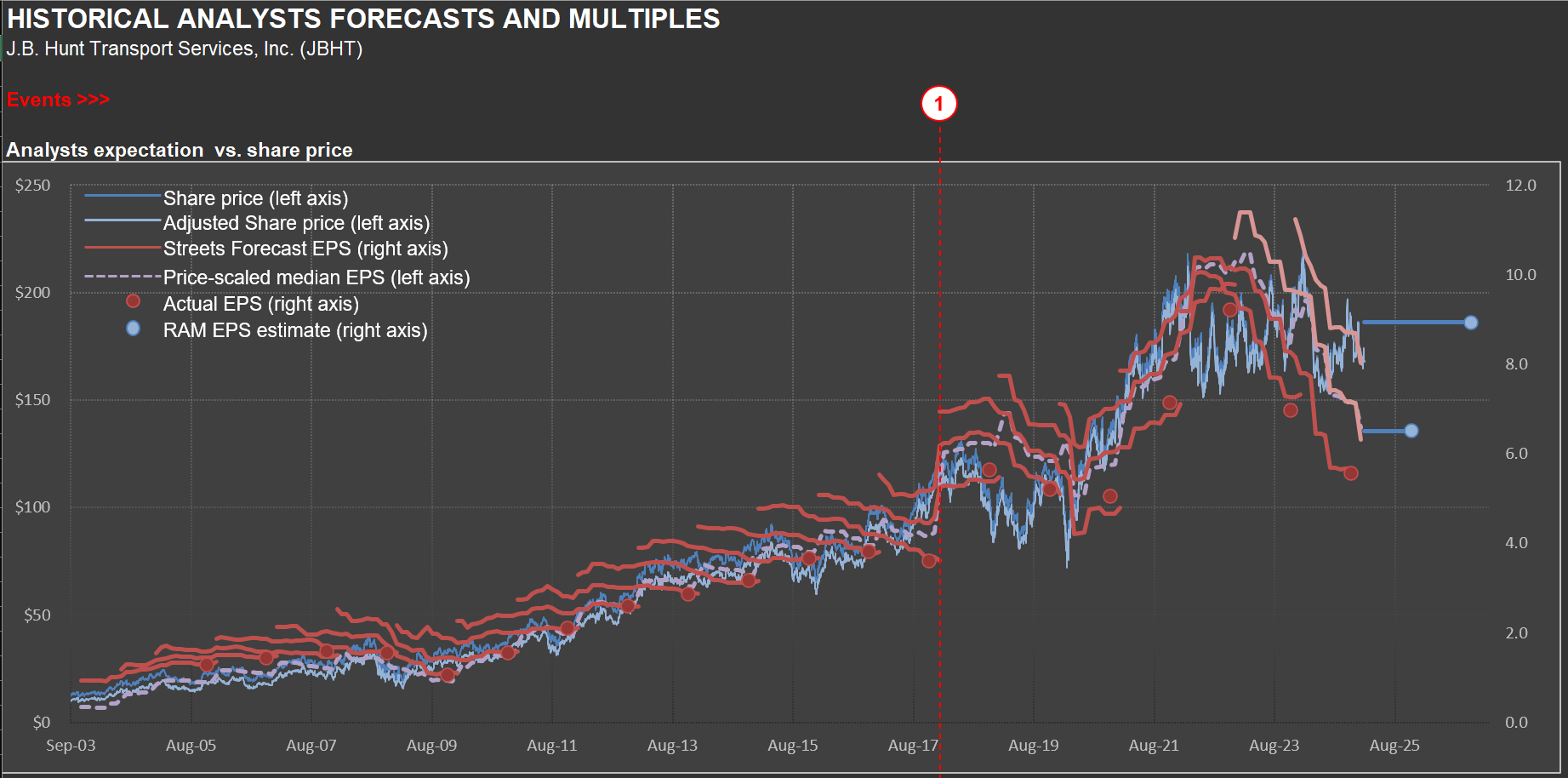

J.B. Hunt: Share Price Defies Earnings Gravity - Market Optimism or Pandemic Memory Bias?

For most companies, share prices follow short-term EPS (in other words, the Market doesn’t anticipate much—it just reflects what it sees “as of now”). It isn’t different for $JBHT — see how the share price follows expected EPS on the chart. However, the current market price appears to be fighting a substantial decline in earnings. Maybe it’s because trucking companies made a disproportional amount of money during the pandemic, biasing some investors regarding how much they are willing to pay for J.B. Hunt’s earnings.

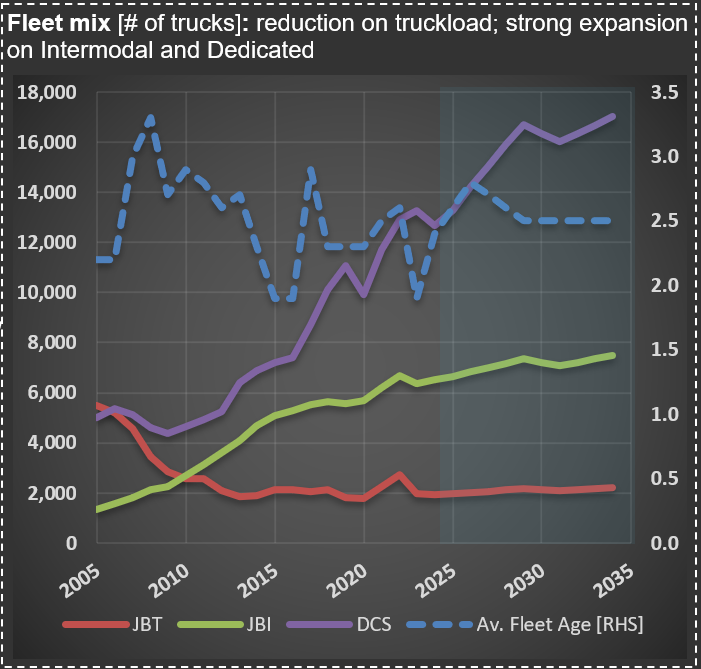

Fleet Age Dynamics: How J.B. Hunt's Minor Aging Shifts Drive Major Truck Purchase Swings

I’m working on $JBHT [J.B. Hunt] today. It is incredible how relatively small fluctuations in the average age of a trucking company’s fleet (represented by the dashed blue line on the chart) change the demand for new trucks. The company went from buying almost 6,000 trucks in 2021/2022 to something close to 3,600 trucks now.

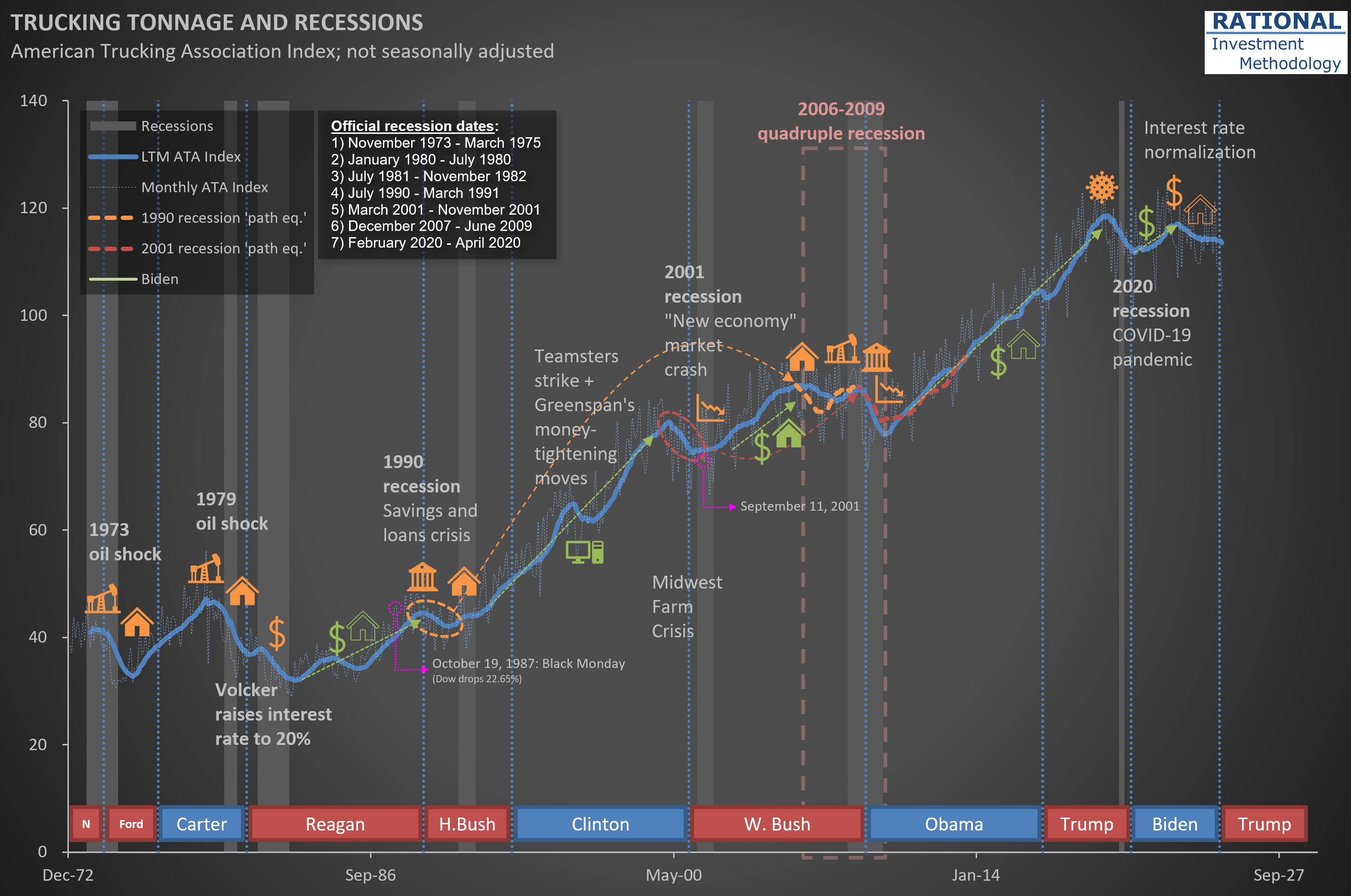

Trucking Tonnage Trends: What ATA Data Reveals About Economic Momentum

Trucking tonnage data from the American Trucking Association (ATA) reveals a persistent sluggishness in demand for trucking services. Take a look at the long-term perspective in the chart below, which helps contextualize current industry conditions within historical patterns.

The visualization offers valuable insights into freight movement trends—often considered a bellwether for broader economic activity. For those monitoring economic signals, this data point merits attention alongside other indicators when evaluating the current business cycle position.