How Tariffs and U.S. Housing Trends Shape $MHK’s Outlook

I’ve just finished updating my analysis on $MHK (Mohawk Industries), the world’s largest flooring manufacturer. $MHK produces and distributes a broad range of flooring products-including ceramic tile, carpet, laminate, luxury vinyl tile, wood, and stone-serving both residential and commercial markets globally.

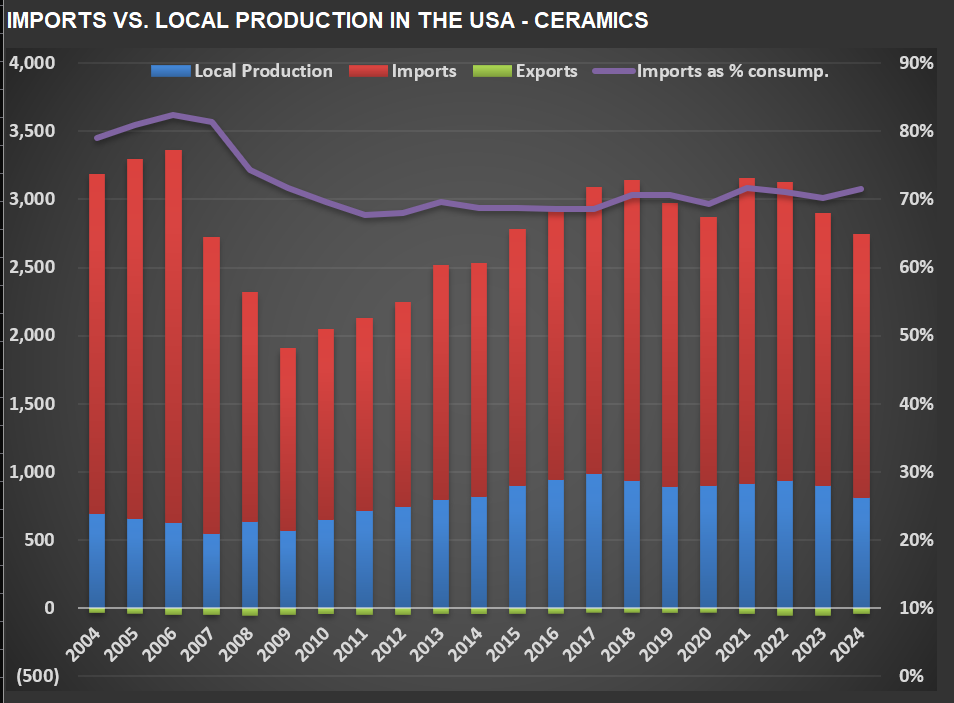

Let’s start with the first chart below, which tracks local production, imports, and exports of ceramic tiles in the U.S. For over two decades, imports have accounted for more than 70% of total U.S. ceramic tile consumption. If tariffs remain at current levels, the purple line (imports as a percentage of consumption) should show a pronounced decline, as higher prices would likely reduce demand and volume.

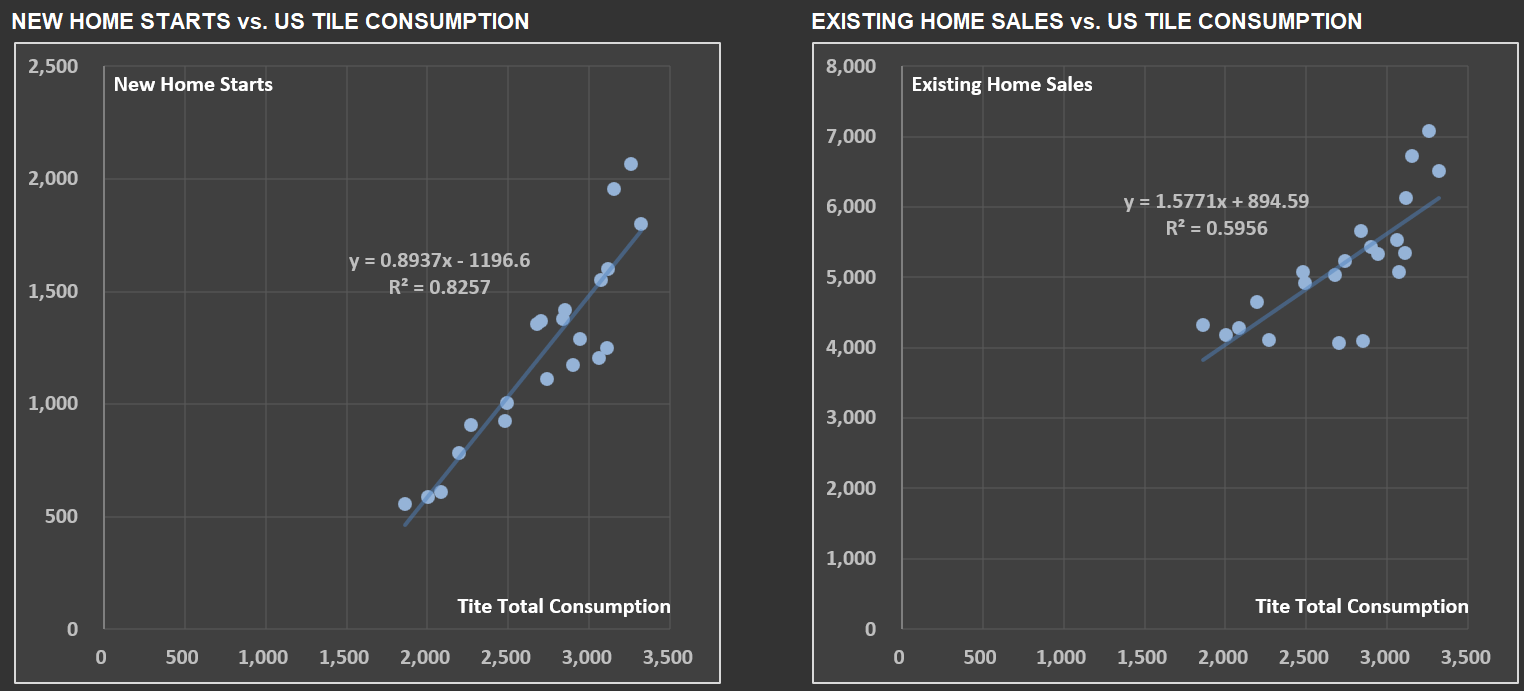

Next, take a look at the two scatter-plot charts. These illustrate the relationship between U.S. tile consumption and two key housing metrics: New Home Starts and Existing Home Sales. As you might expect, tile usage is more closely tied to new construction-hence the higher correlation with New Home Starts (about 83%) compared to Existing Home Sales (around 60%). When new homes are built, more tile is installed; existing home sales, while relevant, have a more modest effect.

Correlations like these are precisely why I analyze not just the operations of companies within RIM’s Circle of Competence (CofC), but also the broader industries they operate in-housing being a prime example. For those interested in a deeper dive, I’ve previously shared posts on New Home Starts and on Existing Home Sales, which provide additional context.