A 1990s Redux? Comparing Walmart’s Current Valuation to the Tech Bubble

A recent article in the Wall Street Journal highlighted concerns regarding the potential overvaluation of Walmart. The article can be accessed here. The author primarily focuses on the forward price-to-earnings ratio, contrasting Walmart’s metrics with those of various technology firms, a clever comparison intended to suggest that there may be an issue with WMT’s stock valuation. Are Walmart’s shares overpriced? Indeed, they are; however, at RIM, given the thoroughness and sophistication of our proprietary models, we rely on more than just multiples, which serve as a simplified valuation reference.

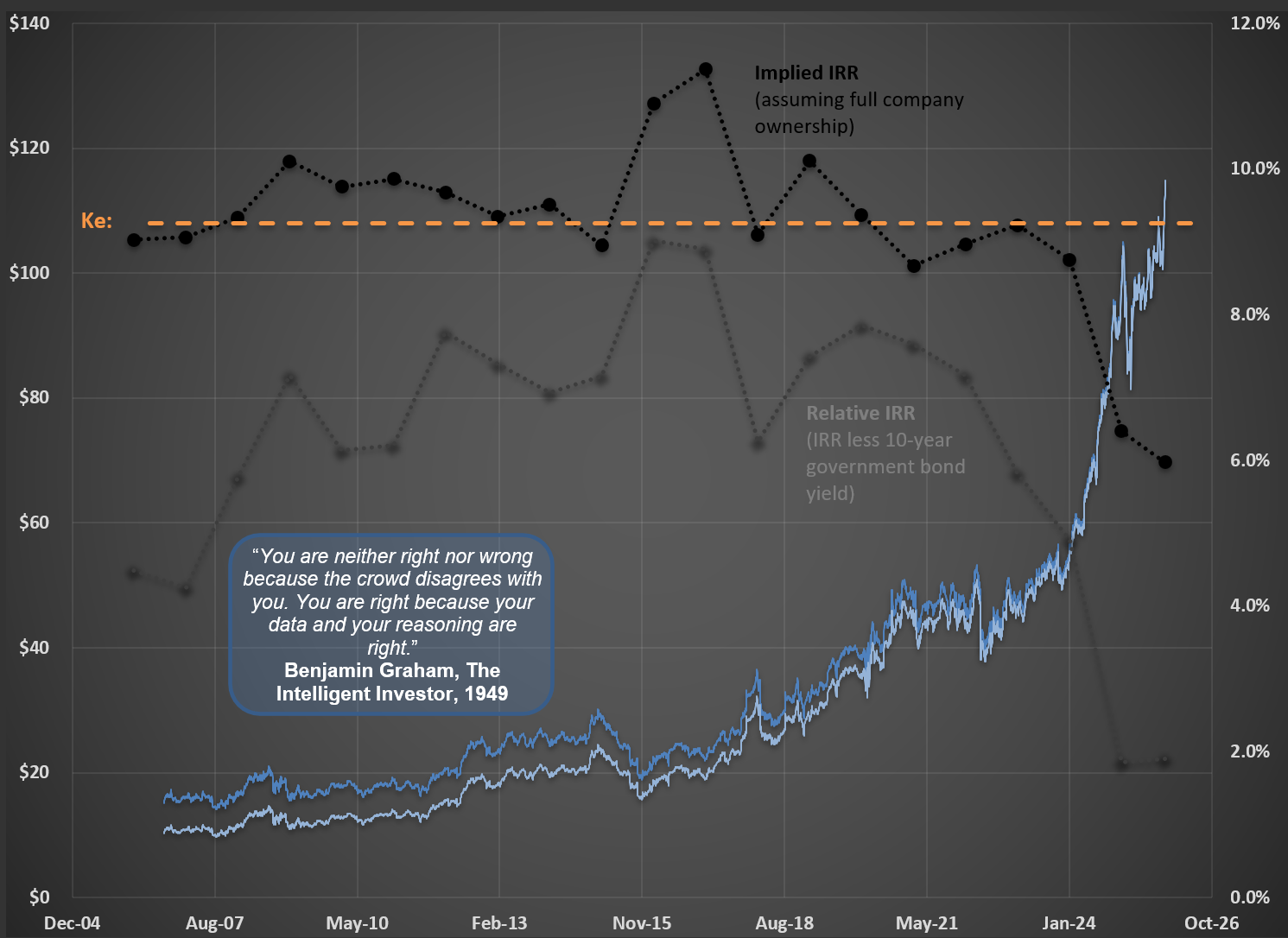

What should be of primary interest to investors is the Internal Rate of Return (IRR) that an investment can generate. Naturally, purchasing an asset at a low price and selling it at a higher price without fully understanding the underlying value may yield a high IRR, but this is not investing—it is merely a fortunate chance. True investing requires acquiring assets only when one believes the underlying business can deliver a historically high IRR, assuming reasonable operational performance.

I dedicate extensive time to researching and modelling companies because I aim to invest in businesses where the implied IRR is substantial—approximately 15% annual gains if one were to acquire the entire business, based solely on genuine cash flow to the owner. Where does Walmart stand on this measure today? The first chart provides the answer: Walmart currently offers an IRR close to 6%, the lowest at any fiscal year-end in the past twenty years (indicated by the dark-dotted line). Historically, Walmart shareholders have enjoyed an implied IRR of around 9.2%. This 3.2% difference significantly impacts cumulative returns over time (the calculations are detailed in this post).

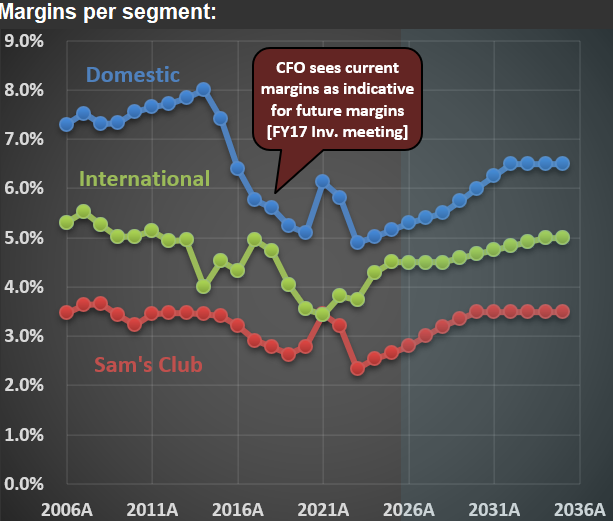

The implied IRRs presented above are derived from RIM’s base-case scenario, which assumes Walmart will improve its margins going forward. The second chart illustrates Walmart’s margins across various segments. It is noteworthy that Walmart’s CFO discussed the prospect of higher margins (approximately 6%) for its domestic business as early as 2017. Except for a few pandemic years, the company has not consistently achieved such margins. Thus, assuming margins increase to levels not regularly seen in over a decade is quite optimistic.

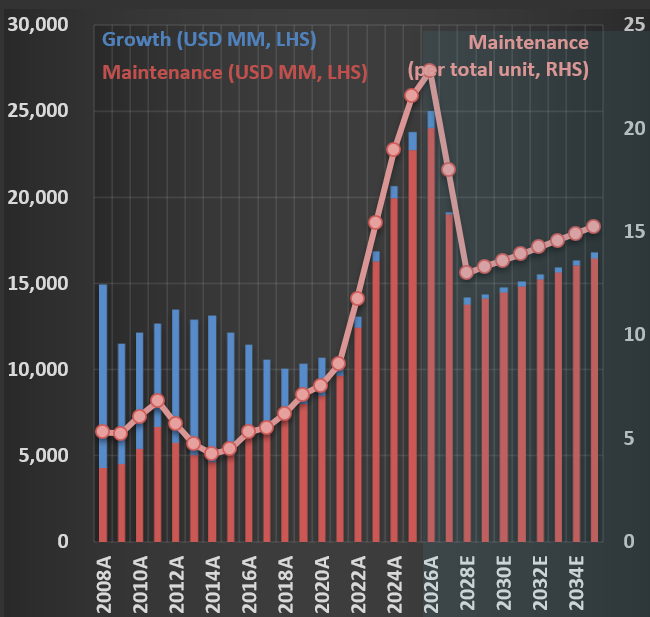

Equally critical to IRRs is the amount of capital expenditure required to attain these margins. The final chart displays Walmart’s capital expenditures over the past two decades and projections for the next ten years. The recent surge in investments is substantial, implying that, all else being equal, higher investment levels reduce cash available to shareholders.

When considering all factors—share price, margins, growth (which has been limited for a mature business like Walmart), and investments—the implied IRR for Walmart stands at a modest 6%. Some may argue that valuations are irrelevant; however, I disagree. As demonstrated in this post, during the 1990s tech bubble, Walmart shares—and a few others—were highly valued. Shareholders who disregarded these elevated valuations at that time experienced poor returns, a scenario that is quite plausible for current Walmart investors purchasing at today’s prices.