Benjamin Graham's Wisdom Applied: Why I Differ on $HD

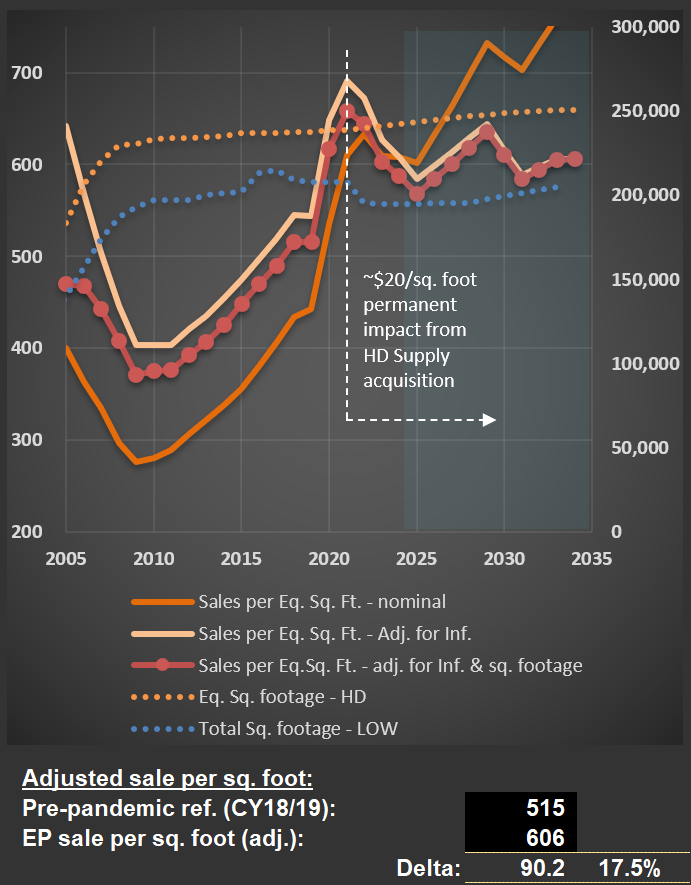

I just finished updating my analysis on $HD (Home Depot), and the outlook for 2025 suggests it will mark the fourth consecutive year of declining sales per square foot, adjusted for inflation. The last comparable period of sustained decline was between 2006 and 2009. You can see this trend clearly in the chart below—focus on the red data series with dots.

This decline reflects the normalization following the post-pandemic boom. During that period, extremely low interest rates, substantial stimulus measures, and increased time spent at home drove a surge in sales for Home Depot and $LOW (Lowe’s). Even factoring in the additional $20 per square foot from Home Depot’s acquisition of HD Supply, my analysis assumes average sales will remain about $70 higher than pre-pandemic levels (see calculations below the first chart). I also assume (not shown in the charts) that the company will maintain healthy margins. I.e., if anything, I’m being aggressive in my forecasts.

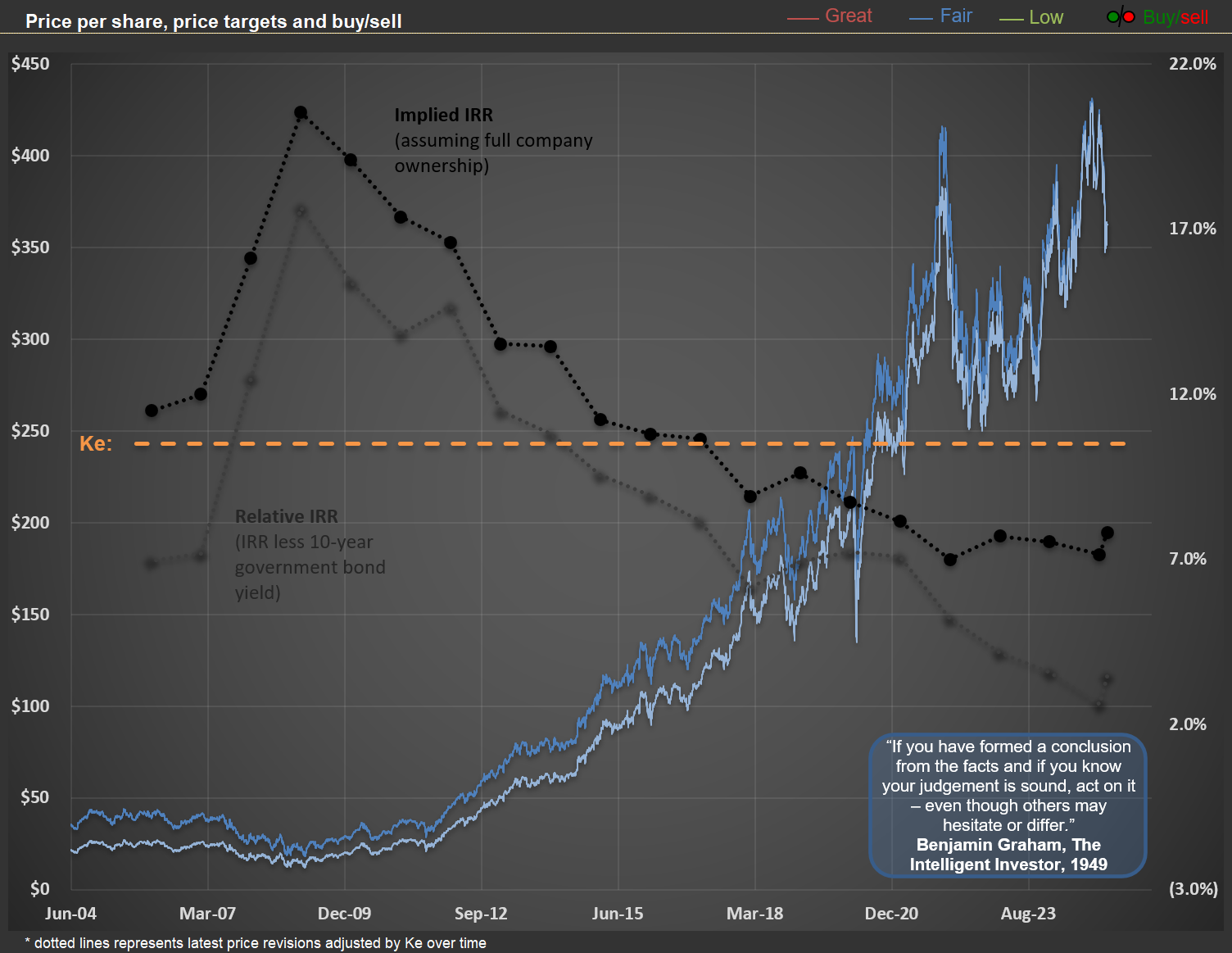

Despite this relatively optimistic assumption regarding future sales and margins, current share prices for HD suggest that long-term investors may achieve modest returns. Based on my base-case scenario, the future IRR (Internal Rate of Return) is projected to be approximately 7% per year. For context, you can read my earlier post on understanding implicit IRRs here.

The second chart below illustrates implicit IRRs for HD at 20 different year-end points. As expected, higher share prices correspond to lower IRRs—this is simply math. If your base-case scenario is well-calibrated, any given share price implies a specific IRR for long-term owners. Historically, the best time to buy HD (and LOW) shares was in 2009, when the implied IRR reached 20.5%. For perspective, this offered a real return (assuming an annual inflation rate of 2.5%) equivalent to multiplying your investment by five over a decade. I presented this analysis at a Value Investing Event in Trani, Italy, although few attendees were enthusiastic about these ideas at the time.

Today’s elevated prices prompt me to recall Benjamin Graham’s timeless advice from The Intelligent Investor, written in 1949: “If you have formed a conclusion from the facts and if you know your judgement is sound, act on it – even though others may hesitate or differ.” In contrast to many analysts nowadays, I believe $HD and $LOW are not attractive investments at current valuations. If sales continue to decline or fail to rebound meaningfully, perhaps the market will eventually acknowledge that these prices imply lower-than-deserved returns for holding these assets.