CofC: Consumer Discretionary - Automobiles & Components

Consumer Confidence and RV Sales: Insights from Thor Industries ($THO)

I just finished updating my analysis of $THO (Thor Industries), the largest manufacturer of RVs (Recreational Vehicles) in the US. The U.S. RV market is dominated by a few major players, often called the “Big 3”: Thor, Forest River (a Berkshire Hathaway company), and Winnebago, an iconic name in the RV world.

Thor’s management shared in their latest earnings release that retail demand has generally aligned with expectations, despite some challenges in the first half of FY25 (August 2024 to January 2025). While there was improvement in the second half, it was less than initially anticipated, prompting a revision of prior guidance. The slight increase in consumer confidence in May 2025 is a positive sign for retail demand through the end of FY25 (July 2025). However, aggressive tariff policies could weigh on demand in the latter half of the calendar year if their impact on Average Sales Prices (ASPs) is not effectively managed industry-wide. They also expect the first quarter of fiscal 2026 (June to August 2025) to be challenging.

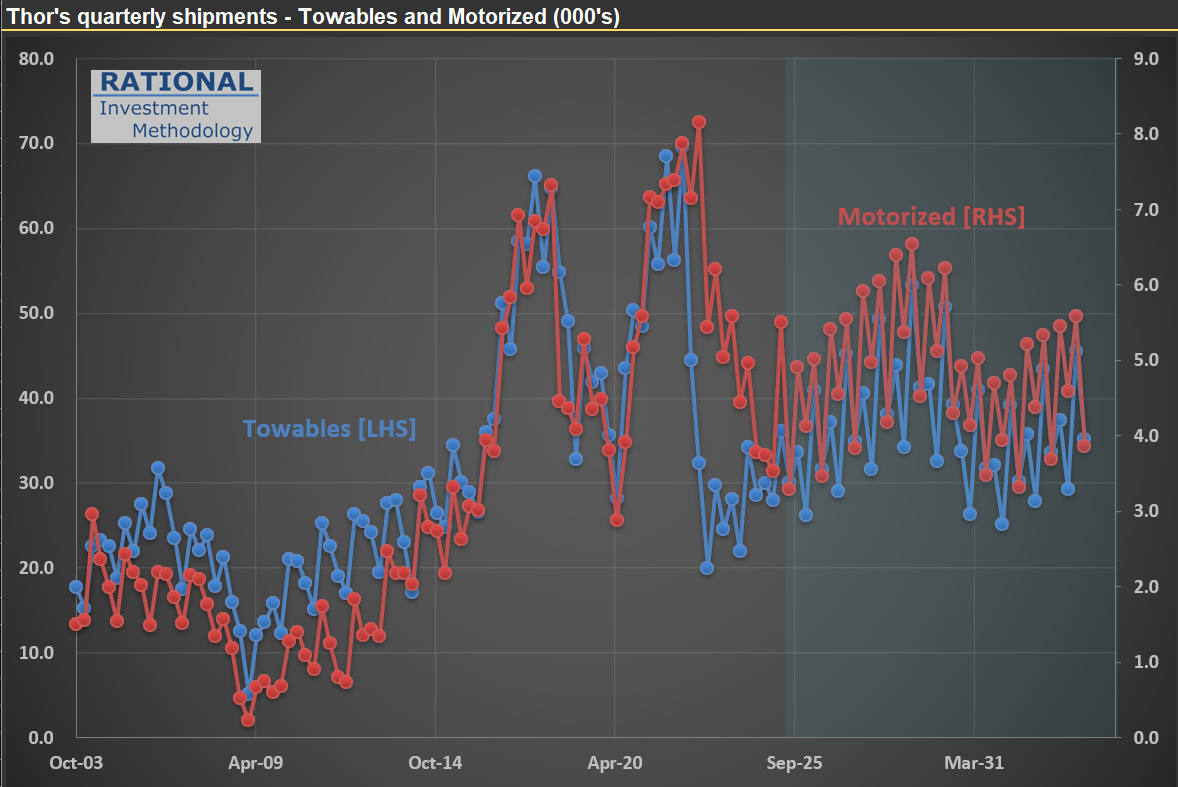

The main reason for this cautious outlook? Tariff uncertainties. Now, consider that Thor has already been navigating significant fluctuations in demand—see the picture below. The blue line illustrates quarterly deliveries in their “towables” segment, the company’s largest. Imagine running a production line that must handle between 20,000 and 70,000 units every three months, without knowing in advance when demand will be strong or weak.

Thor sells highly discretionary products—you don’t really need an RV! Because of this, their sales levels serve as a strong indicator of real consumer confidence. I’ll be watching their numbers closely as we move through what remains an unnecessarily volatile economic and operational environment.

What Harley-Davidson's Financing Data Reveals About the US Consumer

$HOG (Harley-Davidson) operates as two distinct businesses: a motorcycle manufacturer and a consumer financing provider. In fact, Harley-Davidson Financial Services financed over 70% of the motorcycles sold in 2024. Like any company offering financing, it must set aside provisions for potential credit losses.

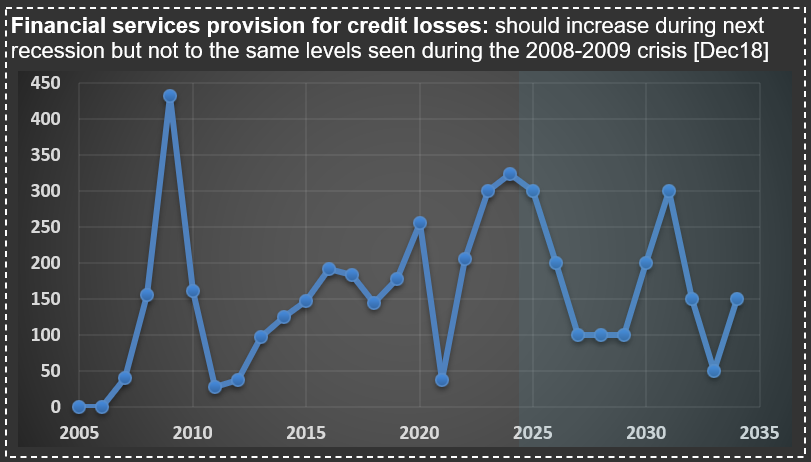

The chart below illustrates these credit loss provisions (in basis points) relative to their total outstanding receivables portfolio. Notice the significant spike in 2009 during the Great Financial Crisis (GFC)—a severity that’s tough to surpass. (You might also spot my 2018 comment, noting future cycles would come, though likely not as extreme as the GFC.)

But more importantly, observe how elevated these provisions have been over the past two years (and likely continuing into 2025). Those surprised by recessionary signals today simply haven’t been paying attention to the right indicators. As I’ve mentioned in previous posts, the US consumer has already exhibited recessionary behavior for some time.

Recreational Boating Market Hits Recession-Era Levels

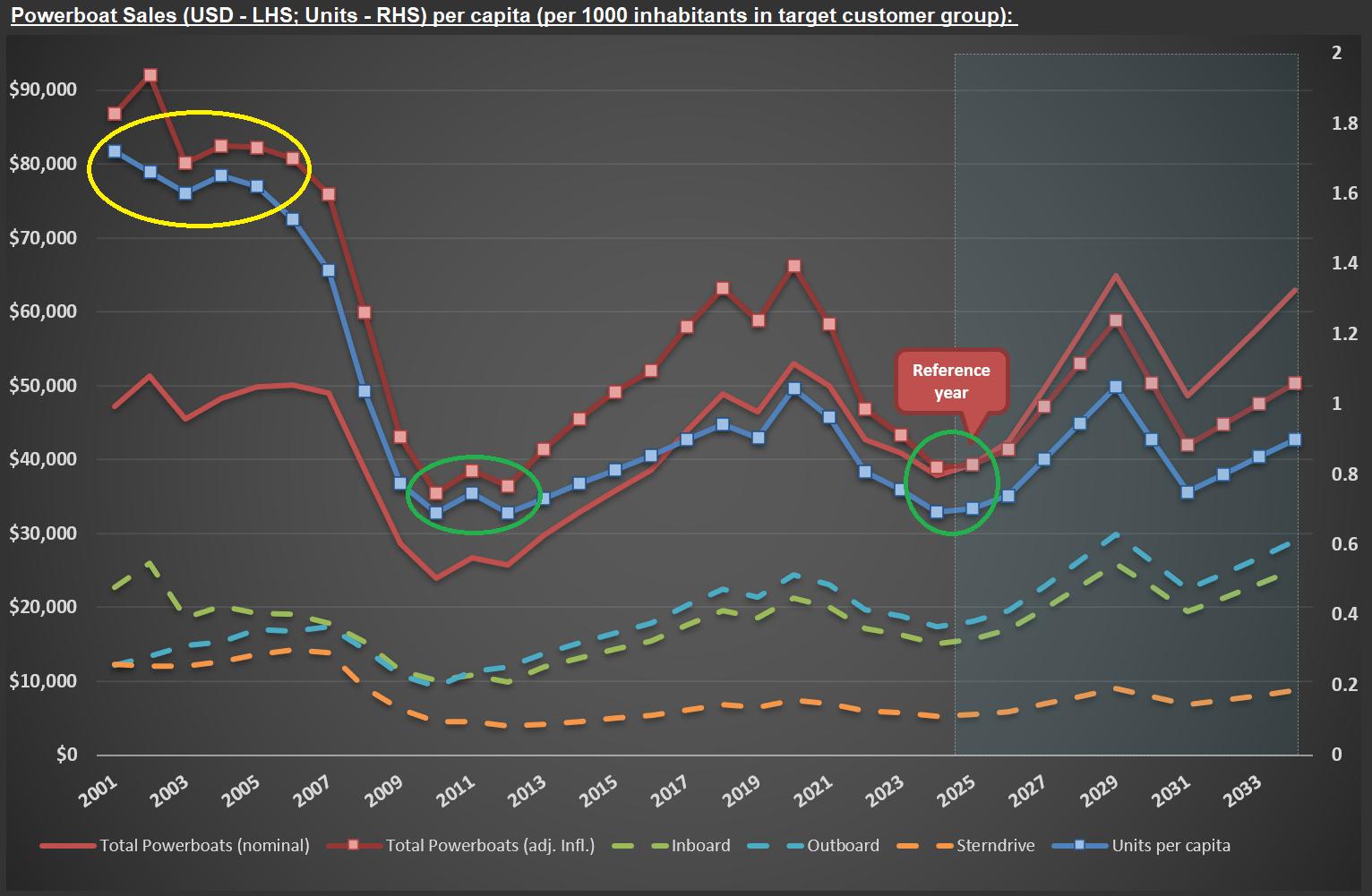

The recreational boating market reveals some concerning trends (which might lead to buying opportunities in the sector). The chart below shows powerboat sales estimates from my $BC (Brunswick) analysis, with the square-marked lines telling an important story. Sales volumes for 2024/2025, measured in units or inflation-adjusted dollars, have retreated to levels we haven’t seen since 2010-2012 – the early recovery period following the Great Recession (circled in green). Even more striking is how these figures compare to the pre-housing bubble era that ended in late 2005 (circled in yellow).

While headline GDP numbers might suggest economic health (I’ll share updated GDP charts and some comments in a future post), the recreational boating industry is experiencing significant challenges. This disconnect between broad economic indicators and sector-specific realities is worth noting for investors.

Brunswick’s recent actions highlight these difficulties. During their Q4 2024 conference call, the CEO candidly shared: “If you look from 1 January 2024 to 31 December, we unfortunately had to exit about 20% of our hourly staff and 7% of our salaried staff. The majority of that happened in the back half of the year when it was clear that we had to reduce our production levels to support year-end inventory levels that we needed to go into 2025.”

What does this mean for the broader discretionary spending landscape? I believe the American consumer is currently in a recession, as comments like the one above - and figures shown in the picture below - don’t show up during a healthy economy. But as always, this too shall pass, and Brunswick and other companies in the sector will revert to normalized sales levels.

America's Declining Motorcycle Market and What It Means for Harley Davidson

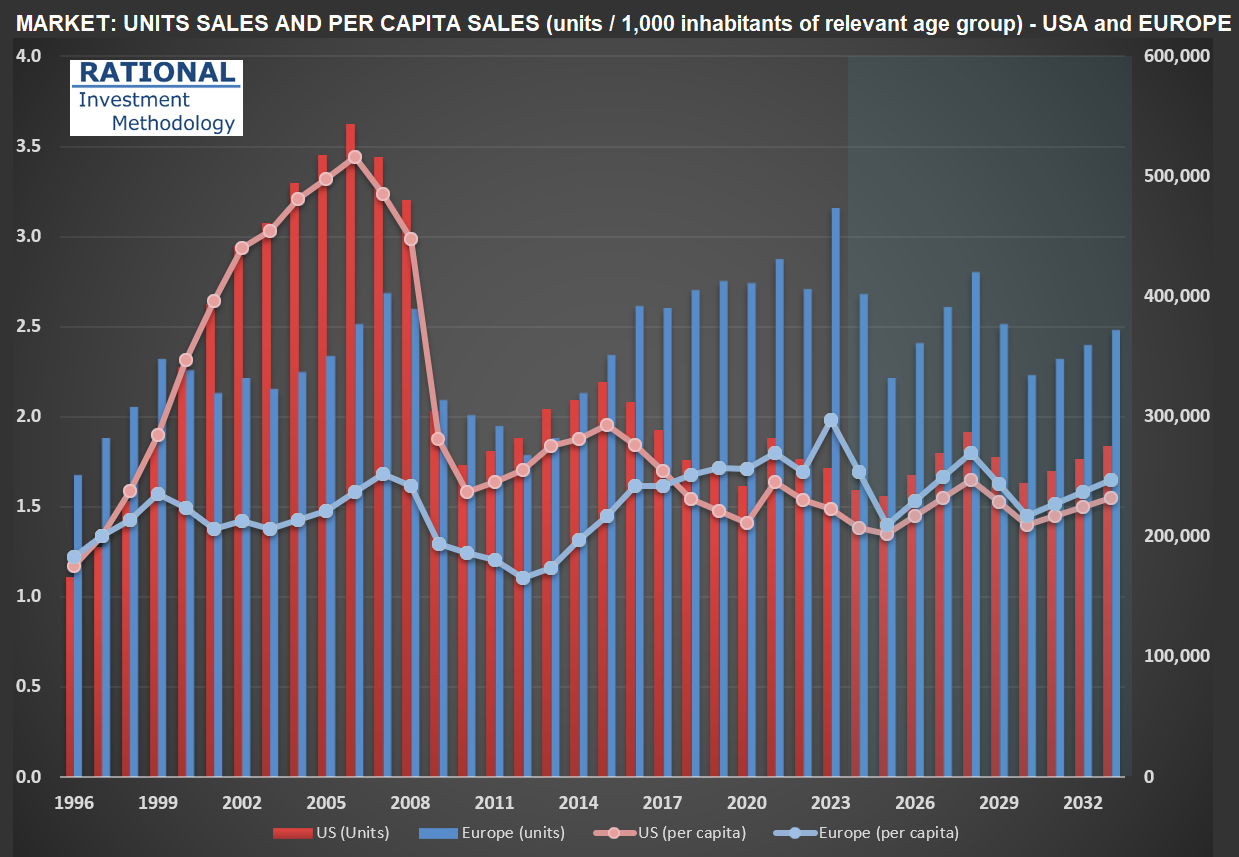

Bloomberg is conducting a comprehensive series of special segments on $HOG [Harley Davidson], highlighting significant shifts in the American motorcycle market - hence this post. The evolution of motorcycle sales per capita in the United States has shown a staggering decline over recent years, as illustrated in the chart below.

Surprisingly, Americans now purchase fewer large motorcycles (over 600cc) than Europeans, despite having advantages that traditionally supported motorcycle ownership: abundant open spaces for riding, widespread garage availability for storage, and higher income per capita. This represents a fundamental shift in the American motorcycle culture that Harley Davidson has long dominated.

As part of my ongoing analysis of recreational vehicle markets, I’m currently researching $BC [Brunswick Corporation], a leader in the marine industry. I’ll be sharing insights on the boating sector soon, examining whether similar consumption pattern changes are occurring across different recreational vehicle categories.